Loading

Get Tp1 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tp1 online

Filling out the Tp1 form online can be a straightforward process when you have clear guidance. This guide provides comprehensive, step-by-step instructions to help users understand each section of the form with ease.

Follow the steps to easily fill out the Tp1 form online.

- Click the 'Get Form' button to access the Tp1 form and open it in your preferred editor.

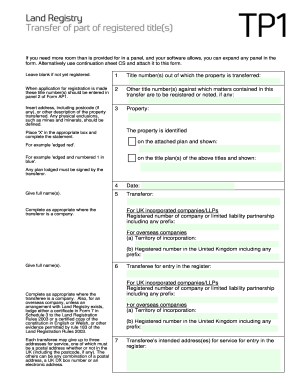

- Begin by entering the title number or numbers from which the property is being transferred. This information is crucial and must be entered in the designated panel of the accompanying Form AP1 when applying for registration.

- In the next field, list any other title numbers against which the matters contained in this transfer should be registered or noted. Ensure you include the complete address along with the postcode for the property being transferred.

- Identify the property by placing an 'X' in the appropriate box and provide a complete description, referring to any plans submitted. Physical exclusions like mines and minerals must be clearly defined.

- Provide the full name of the transferor and, if applicable, complete the appropriate sections regarding the transferor’s company or partnership registration details.

- Enter the transferee's details, including the respective registration number and any necessary addresses for service. For overseas companies, ensure to include the territory of incorporation.

- Indicate the consideration involved in the transfer, whether it is a specific sum or other receipts, by filling in the respective boxes.

- Confirm whether the transferor is providing a full title guarantee or a limited title guarantee by selecting the correct option.

- If the transfer involves multiple transferees, complete the declaration of trust section to clarify how the property will be held.

- Utilize the additional provisions panel to outline anything pertinent that relates to definitions, rights granted or reserved, or any restrictive covenants.

- Make sure the transferor and transferee(s) execute the document correctly, adhering to the formal requirements of executing a deed.

- After completing all the sections, review your entries for accuracy and completeness. You can then save your changes, download, print, or share the form as needed.

Start filling out your Tp1 form online today to ensure a seamless property transfer process.

Failing to file a partnership tax return can lead to severe penalties and interest on any unpaid taxes. The IRS expects timely submission to maintain compliance, and missing this deadline can result in a significant financial burden. Moreover, not filing may affect your partners' Schedules K-1, complicating their tax situations too. Consider utilizing U.S. Legal Forms to avoid these issues related to your TP1 return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.