Get Explain Why Each Account May Require Adjustment 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Explain Why Each Account May Require Adjustment online

How to fill out and sign Explain Why Each Account May Require Adjustment online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience all the benefits of submitting and finalizing forms online.

Utilizing our service, submitting Explain Why Each Account May Require Adjustment only requires a few moments.

Submit the new Explain Why Each Account May Require Adjustment electronically as soon as you finish it. Your data is secure, as we adhere to the latest security standards. Join millions of satisfied customers who are already completing legal forms from the comfort of their homes.

- Choose the template you need from the collection of legal form examples.

- Click the Get form button to access the document and begin editing.

- Complete all the required fields (they will be highlighted in yellow).

- The Signature Wizard will enable you to add your electronic signature once you have entered your details.

- Enter the date.

- Review the entire form to ensure you have provided all the information and that no modifications are necessary.

- Click Done and download the completed template to your device.

How to Alter Get Explain Why Each Account May Require Modification 2020: personalize forms online

Complete and endorse your Get Explain Why Each Account May Require Modification 2020 swiftly and accurately. Obtain and adjust, and endorse adaptable form samples conveniently in one tab.

Your document process can be significantly more effective if everything needed for alteration and managing the workflow is consolidated in a single location. If you are searching for a Get Explain Why Each Account May Require Modification 2020 form example, this is the ideal spot to obtain it and fill it out without needing external solutions.

Simply enter the name of the Get Explain Why Each Account May Require Modification 2020 or any other form and locate the correct example. If the example appears appropriate, you can begin altering it immediately by clicking Get form. No need to print or download it.

Hover and click on the interactive fillable fields to input your information and endorse the form in one editor. Utilize additional modifying tools to personalize your template: Check interactive checkboxes in forms by clicking them. Inspect other sections of the Get Explain Why Each Account May Require Modification 2020 text with the help of the Cross, Check, and Circle tools.

Conceal text portions using theErase and Highlight, or Blackout tool. Include custom components like Initials or Date using the designated tools, which will be generated automatically. Save the form on your computer or convert its format to your preferred type. When equipped with a clever forms catalog and an efficient document editing solution, managing documentation becomes simpler. Locate the form you need, fill it out instantly, and endorse it right away without downloading it. Simplify your paperwork routine with a solution tailored for adjusting forms.

- If you need to integrate more text into the document, use the Text tool or add fillable fields with the corresponding button.

- You can also define the details of each fillable field.

- Incorporate images to forms with the Image button.

- Upload images from your device or capture them with your computer's camera.

- Add unique visual elements to the document. Use Draw, Line, and Arrow tools to illustrate on the document.

- Overlay the text in the document if you wish to obscure it or emphasize it.

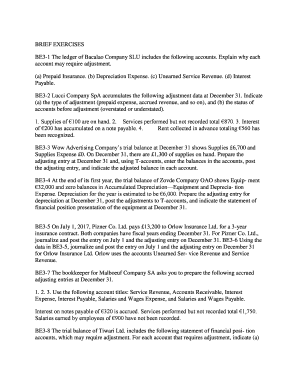

The objective of adjusting entries is to ensure that financial statements provide an accurate representation of a business’s performance over a specific period. These adjustments align recorded transactions with the actual financial activities, helping to match income and expenses correctly. As a result, businesses achieve transparency in their reporting. Overall, adjusting entries serve a fundamental role in accounting.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.