Get Extended Declaration For Non Individual Entities 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Extended Declaration For Non Individual Entities online

This guide provides essential information and step-by-step instructions for completing the Extended Declaration For Non Individual Entities online. Whether you are filling out the form for the first time or are looking for clarification, this comprehensive guide is designed to assist you in accurately providing the necessary information.

Follow the steps to complete the form efficiently.

- Click the ‘Get Form’ button to access the Extended Declaration For Non Individual Entities form and open it in your preferred editor.

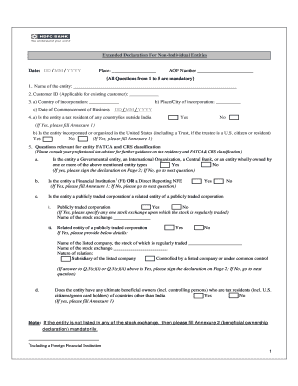

- Begin by providing the required basic information in Section 1. Input the name of the entity as it appears in official documents.

- In Section 2, enter the Customer ID if you are an existing customer. If you are a new user, this field can be left blank.

- For Section 3, fill in the following details: a) Identify the country of incorporation of the entity. b) Specify the city of incorporation. c) Enter the date of commencement of business in the DD/MM/YYYY format.

- In Section 4, respond to the questions regarding tax residency: a) Indicate whether the entity is a tax resident of any country outside India. b) Confirm if the entity is incorporated or organized in the United States. If you answer 'Yes' to either question, complete Annexure 1.

- Proceed to Section 5 and carefully consider each relevant question pertaining to FATCA and CRS classification: a) State if the entity is a governmental entity or central bank. If yes, sign the declaration on Page 2. b) If the entity is a financial institution or a direct reporting NFE, complete Annexure 1. c) Identify if it is a publicly traded corporation and provide the necessary stock exchange details if applicable.

- Complete any additional inquiries about ultimate beneficial owners or controlling persons in Section 5d. If applicable, specify foreign tax residency details in Annexure 1.

- Once all sections are filled out, review the form for accuracy. Ensure that all mandatory questions are answered and confirm your understanding regarding the certification statement.

- Finally, you may choose to save your changes, download, print, or share the completed form as needed.

Take the next step in your compliance process by filling out the Extended Declaration For Non Individual Entities online today.

Annexure 1 in HDFC Bank pertains to the documentation needed for individuals under FATCA regulations. This annexure captures essential information regarding the individual's identity and tax status. Completing this accurately directly supports your Extended Declaration for Non Individual Entities, ensuring compliance and efficiency.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.