Loading

Get Png Irc Form G1 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Png Irc Form G1 online

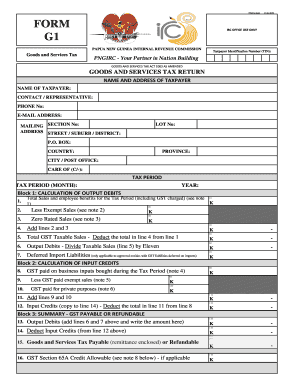

This guide provides clear and step-by-step instructions on how to accurately fill out the Png Irc Form G1 online. By following these instructions, users can ensure that their Goods and Services Tax submissions to the Papua New Guinea Internal Revenue Commission are completed correctly.

Follow the steps to successfully complete your form online.

- Press the ‘Get Form’ button to download and open the Png Irc Form G1 in your editor.

- Begin filling out the taxpayer information section. Provide your name, address, contact details, and Taxpayer Identification Number (TIN). Ensure all information is accurate to avoid processing delays.

- Indicate the tax period by selecting the month and year for which you are filing. This is critical for timely and accurate tax reporting.

- In Block 1, calculate your Output Debits. Start by entering your total sales (including GST charged) for the tax period. Remember to deduct any exempt or zero-rated sales before calculating the GST taxable sales.

- In Block 2, calculate your Input Credits. Enter the GST paid on business inputs purchased during the tax period. Complete the calculations as directed in the form notes to arrive at your total Input Credits.

- In Block 3, summarize your results. Add your Output Debits and subtract your Input Credits to determine whether you owe GST or are eligible for a refund.

- Complete any optional credit transfers if applicable. Provide details of the tax type and amount for transferring credits.

- Review your form for accuracy. Ensure all calculations are correct and that you have signed and dated the form.

- Once satisfied, save your changes. You may then download, print, or share the form as needed to complete your filing process.

Get started on your Png Irc Form G1 online today to ensure your tax obligations are met accurately and on time.

You should report GST during the designated filing periods set by the PNG IRC, typically quarterly or annually. It's crucial to keep track of these deadlines to avoid any penalties. Utilize the Png Irc Form G1 to report your GST in a timely manner. To simplify tracking and reporting, consider the resources available on uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.