Loading

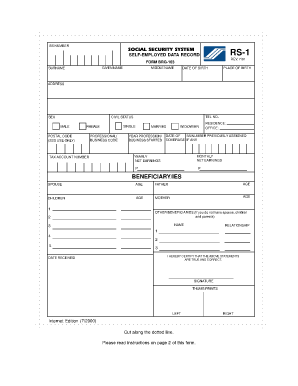

Get Sss Requirements For Self Employed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sss Requirements For Self Employed online

Completing the Sss Requirements For Self Employed form is a crucial step for individuals wishing to enroll in the Social Security System. This guide provides a clear, step-by-step approach to filling out the form online, ensuring that users do not miss any essential information.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling in your given name, middle name, and surname. These fields are essential for identification. Make sure to enter these names as they appear on your documents.

- Provide your personal details including place of birth, date of birth, and civil status. Ensure that all information is accurate to avoid any issues with processing.

- Enter your Social Security number (SS number) and indicate the previous SS number, if any. This step is critical as an SS number is unique to each individual.

- Complete the address section by providing your current residential address along with contact telephone number. This will be used for any correspondence.

- Fill in your professional or business code and date when your business started. This information helps in determining your eligibility for specific benefits.

- Detail your monthly and yearly net earnings. This will assist in the calculation of your contributions and benefits.

- List your spouse, children, and parents if applicable, including their ages and relationship to you. This information is needed for beneficiary designation.

- If you have additional beneficiaries, provide their information in the designated section, ensuring correct relationships are noted.

- Review the entire form for completeness and accuracy before signing. Your signature, date received, and thumbprints will attest to the correctness of the information.

- Finally, after ensuring all information is accurate and complete, save any changes made, download the form, and print or share it as needed.

Complete your Sss Requirements For Self Employed form online today to secure your eligibility for benefits.

SSS verification requires you to submit valid identification, proof of income, and any other documents as specified by the SSS. This process is crucial for ensuring that you meet the SSS requirements for self-employed individuals. Using platforms like US Legal Forms can help you understand and gather the necessary forms for verification efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.