Get Mass Form 84

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mass Form 84 online

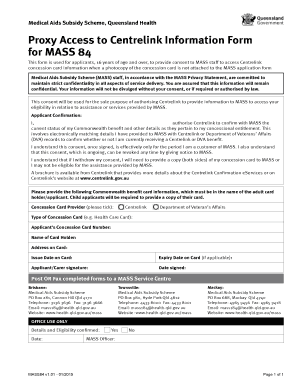

Filling out the Mass Form 84 is essential for applicants to provide consent for the Medical Aids Subsidy Scheme (MASS) staff to access Centrelink information. This guide offers clear steps to help you complete the form easily and accurately online.

Follow the steps to fill out the Mass Form 84 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the required applicant information. Fill in your name in the designated field, ensuring it matches the details on your identification documents.

- Select the appropriate concession card provider by ticking either Centrelink or the Department of Veteran’s Affairs.

- Enter the type of concession card you possess, such as Health Care Card, in the specified section.

- Provide your Concession Card Number in the relevant field. Double-check for accuracy to avoid processing delays.

- Fill in the name of the card holder, ensuring it corresponds to the name on the concession card.

- Input the address as it appears on the concession card. This information is crucial for correct identification.

- Indicate the issue date and expiry date of the card if applicable. This helps verify the validity of your concession.

- Sign the form in the designated area as the applicant or carer, and ensure that the date signed is current.

- After completing the form, review all entries for completeness and accuracy before submission.

- Save your changes, and then you can download, print, or share the completed form as needed.

Complete your Mass Form 84 online today to ensure you receive the assistance you need.

To file an appeal with Mass Tax Connect, you need to log into your account and select the option for appeals or disputes. Fill out the required information accurately and attach supporting documents to back your appeal. Furthermore, if you have questions during your process, consider exploring resources available through Mass Form 84. They can provide clarity on what is needed to strengthen your appeal effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.