Loading

Get Erc Broker 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Erc Broker online

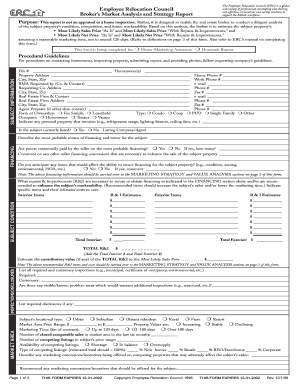

The Erc Broker form is a crucial document that helps real estate brokers analyze property conditions and marketability. This guide provides step-by-step instructions on how to accurately complete the form online, ensuring that all necessary details are captured for a thorough assessment.

Follow the steps to successfully complete the Erc Broker form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by filling out the subject information section. Provide the file number, names of homeowners, property address, and contact details for both the homeowner and requesting company.

- Indicate whether the form is being completed for home-marketing assistance or homesale buyout by checking the appropriate box.

- In the financing section, detail any necessary financing information, including whether points are customarily paid by the seller and other concessions that may enhance the sale.

- Document the repairs and improvements necessary for financing and their estimated costs under the subject condition section.

- Record all required inspections and disclosures, noting any visible problem areas that may need further inspection.

- In the market area section, provide comprehensive information about the property’s location, price range, and current market conditions.

- Complete the grids comparing the subject property with competing listings and recent sales, ensuring to rate each item accurately.

- In the additional comments section, elaborate on significant features of the property and any other items that may affect its marketability.

- Finally, review all entered data for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your documents online today and ensure accurate submissions!

To record an ERC refund in QuickBooks Desktop, you'll first need to create a journal entry reflecting the refund amount. Then, categorize it properly within your accounts to ensure it reflects correctly in your financial statements. Partnering with an Erc Broker can simplify this process, providing guidance on best practices and ensuring your records are accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.