Loading

Get Cb Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cb Pdf online

Filling out the Cb Pdf online can be a straightforward process when you break it down into manageable steps. This guide will walk you through each section and field, providing clear and detailed instructions to ensure your form is completed accurately.

Follow the steps to successfully complete the Cb Pdf online.

- Click the ‘Get Form’ button to access the Cb Pdf. This will allow you to open the form in an online editor where modifications can be made.

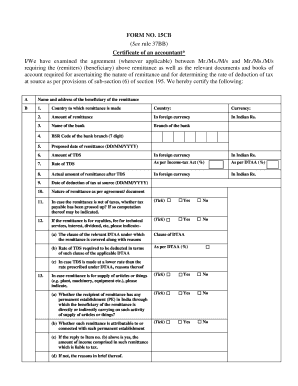

- Begin by entering the name and address of the beneficiary of the remittance in Section A. Ensure that all information is current and accurately reflects the recipient.

- In Section B, fill in the details of the remittance. Start with the country to which the remittance is made, selecting the appropriate country from the dropdown menu, and indicate the currency being used.

- Record the amount of remittance, both in foreign currency and converted to Indian Rupees. This data is crucial for tax calculations.

- Provide the name of the bank and the branch where the transaction will be processed. Additionally, enter the BSR Code of the bank branch, which is essential for identification.

- Specify the proposed date of remittance in the format DD/MM/YYYY. This helps to establish a timeline for the transaction.

- Fill out the amount of Tax Deducted at Source (TDS) in both foreign currency and Indian Rupees in the respective fields.

- Indicate the applicable TDS rate according to the Income-tax Act and the Double Taxation Avoidance Agreement (DTAA) if applicable.

- Calculate and enter the actual amount of remittance after TDS deductions in both foreign currency and Indian Rupees.

- Provide the date of TDS deduction, again using the DD/MM/YYYY format.

- Describe the nature of the remittance as outlined in the agreement or relevant document.

- If the remittance is net of taxes, indicate whether the tax payable has been grossed up, and check the appropriate box. Include any necessary computations.

- For royalties, fees for technical services, and similar remittances, confirm if these payments fall under specific DTAA clauses, and provide detailed information as requested.

- In case of remittances for supplies (like plant or machinery), answer questions regarding the recipient's permanent establishment in India.

- If any orders have been obtained from the Assessing Officer under sections 195(2), 195(3), or 197 of the Income Tax Act, include relevant details.

- Finally, if tax has not been deducted at source for any reason, provide explanations. Attach additional sheets if necessary.

- After completing all sections, save changes made to the form, and consider options to download, print, or share the completed document as needed.

Complete your forms online today for a more efficient filing process.

A CB certificate, or Certificate of Benefit, is a document that outlines benefits or confirmations related to a legal matter. These certificates can serve various purposes, such as validating claims or providing evidence in court. Properly handling CB certificates ensures that all documentation remains consistent and reliable, especially when converting to CB Pdfs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.