Loading

Get Verification Of Mortgage Form Fannie Mae 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Verification Of Mortgage Form Fannie Mae online

This guide provides clear and concise instructions on how to accurately complete the Verification Of Mortgage Form Fannie Mae online. By following these steps, users can ensure a smooth and efficient application process for mortgage verification.

Follow the steps to successfully complete the Verification Of Mortgage Form Fannie Mae online.

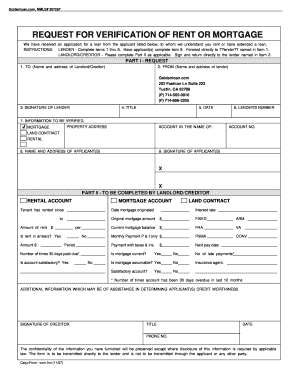

- Click the ‘Get Form’ button to download the Verification Of Mortgage Form Fannie Mae and open it in your preferred document editor.

- In Part I, start with the 'TO' section by entering the name and address of the landlord or creditor responsible for the mortgage verification.

- Next, fill in the 'FROM' section with the name and address of the lender requesting the verification, including the contact information for Goldenloan.com.

- Sign the document in the 'SIGNATURE OF LENDER' field and include your title and the current date.

- Provide the lender's number as this will be required for identification purposes.

- Indicate the information to be verified, including the property address, mortgage account details, and the account under the name of the applicant.

- List the applicant's name and address in the provided 'NAME AND ADDRESS OF APPLICANT(S)' section.

- In Part II, if you are the landlord or creditor, complete the rental or mortgage account information including the date the tenant has rented from or the mortgage origin date and original mortgage amount.

- Indicate current mortgage balance, payment details, and whether the rent is in arrears, including the amount and period.

- Provide insights into account satisfaction, including the number of times payments have been late and if the mortgage is assumed.

- Include any additional information that may assist in determining the applicant's creditworthiness.

- Finally, sign the form as the creditor, include your title, date, and phone number for any required follow-up.

Complete your documents online and streamline your verification process.

To obtain a verification of a mortgage, you typically need to contact your lender directly. They may require a signed request or to fill out a specific form. Using platforms like uslegalforms, you can efficiently find and fill out the necessary forms, including the Verification Of Mortgage Form Fannie Mae, simplifying the entire process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.