Get Indemnity Bond 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indemnity Bond online

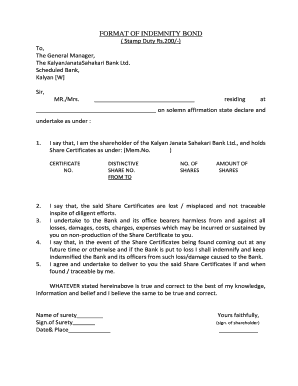

Filling out an Indemnity Bond online is an important step in protecting both the shareholder and the bank in the event of lost share certificates. This guide provides clear, step-by-step instructions to help you navigate the process confidently and accurately.

Follow the steps to complete the Indemnity Bond online.

- Click the ‘Get Form’ button to access the Indemnity Bond and open it in your browser or editor of choice.

- Begin by entering your name in the designated field, starting with 'Mr./Mrs.' and filling in your full name.

- Provide your residential address in the specified section, ensuring all details are correct.

- In the section regarding shareholding, state that you are a shareholder of Kalyan Janata Sahakari Bank Ltd. Additionally, list the share certificates you hold by filling in the membership number, certificate number, distinctive share numbers, and the total number of shares.

- Declare that the share certificates are lost or misplaced, confirming that you have made diligent efforts to locate them.

- Include your commitment to indemnify the bank against any losses or damages that may result from the non-production of the share certificates.

- Acknowledge that if the share certificates are found in the future, you will return them to the bank.

- At the end of the form, sign your name as the shareholder and include the date and place of signing.

- Lastly, you can save your changes, download the completed form, print it, or share it as needed.

Start completing your Indemnity Bond online today for a secure and efficient process!

Related links form

You can obtain an indemnity bond through licensed surety bond companies or specialized online platforms. Many websites, including uslegalforms, offer resources to help you find and understand the requirements for obtaining an indemnity bond. When searching for a bond provider, it is essential to choose one that has a good reputation and experience in the field. This way, you ensure a smoother process and reliable coverage.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.