Get M2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M2 Form online

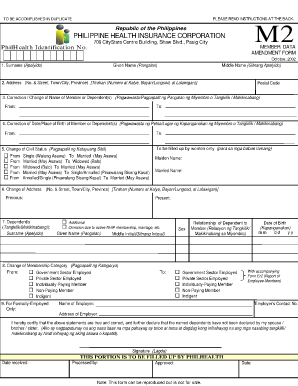

Filling out the M2 Form online may seem daunting, but with clear instructions, you can easily complete it. This guide provides a detailed walkthrough of each section, ensuring you have all the necessary information to submit your form accurately.

Follow the steps to successfully complete the M2 Form online.

- Press the ‘Get Form’ button to access the M2 Form. This action will allow you to retrieve the document and open it for editing.

- Begin by entering your member data. Fill in the surname, given name, and middle name in the designated fields.

- Next, provide your full address including street number, town or city, province, and postal code.

- If you are making a correction or change of name for yourself or your dependent(s), complete the respective fields by indicating the names as 'From' and 'To'.

- For correcting the date or place of birth of a member or dependent, fill in the current details under 'From' and the correct details under 'To'.

- If applicable, state any changes to civil status. Indicate 'From' and 'To' for your current status, using the options provided.

- Provide information on any change of address by stating both the previous address and the new address.

- List any dependents by filling in their respective surname, given name, and middle initial.

- Indicate any changes in membership category by selecting the previous category and the new category.

- Complete the section for formally-employed individuals by entering relevant details such as sex, relationship of dependent to member, date of birth, name of employer, employer’s contact number, and address.

- Affirm the truthfulness of the information provided by signing the form.

- After completing the form, save your changes. You can choose to download, print, or share the form as needed.

Start filling out your M2 Form online today for a smooth and efficient process.

Schedule A is utilized for itemizing deductions you can claim on your individual tax return, such as mortgage interest, charitable contributions, and medical expenses. It allows you to potentially reduce your taxable income more than the standard deduction would. While it serves a different purpose than the M2 Form, ensuring you understand both forms can help maximize your tax benefits. Thus, proper use of Schedule A can contribute significantly to your overall financial strategy.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.