Loading

Get Form Pa 1897 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Pa 1897 online

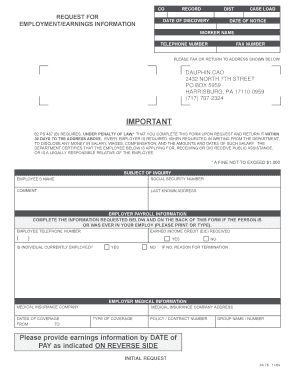

Filling out the Form Pa 1897 online can streamline the process of submitting employment and earnings information. This guide provides step-by-step instructions to help you accurately complete the form, ensuring all necessary details are included for a successful submission.

Follow the steps to fill out Form Pa 1897 accurately.

- Click 'Get Form' button to obtain the form and open it in your digital editor.

- Provide the required details in the 'Subject of Inquiry' section. This includes the employee's name, social security number, and last known address.

- Complete the 'Employer Payroll Information' section, including whether the individual is currently employed and reason for termination if applicable.

- Fill out the employer's medical information, specifying the medical insurance company, dates of coverage, type of coverage, and policy or contract number.

- Submit earnings information by date of pay. Make sure to specify actual dates of pay and ensure they are not merely summarized as 'pay period ending.'

- If applicable, utilize the space provided for additional comments to clarify information or provide context.

- Provide your name, title, signature, and contact information as the employer's representative, and ensure you date the form.

- Upon completing the form, you can save your changes, download the document for your records, print a copy, or share the form electronically with the designated recipient.

Start filling out your Form Pa 1897 online to ensure a timely and accurate submission.

To obtain a PA state tax certificate, contact the Pennsylvania Department of Revenue. They will provide you with the steps required for application. Additionally, having all necessary forms, such as Form PA 1897, completed beforehand can help speed up the process. For more detailed assistance, consider exploring uslegalforms for resources and guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.