Loading

Get Form Wr 30 New Jersey 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form WR-30 New Jersey online

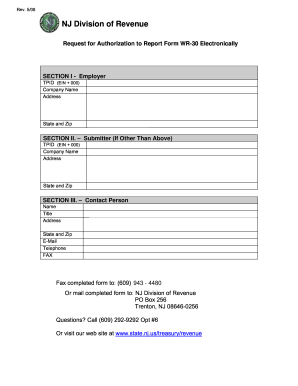

Filling out the Form WR-30 is essential for employers in New Jersey who wish to report their information electronically. This guide will walk you through each section of the form to ensure a smooth and efficient process.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to obtain the form and access it in the online editor.

- In Section I, enter your employer information. Provide your TPID (Employer Identification Number followed by '000'), company name, address, and state along with the zip code.

- If the submitter is different from the employer, complete Section II. Fill in the submitter's TPID, company name, address, state, and zip code.

- Move on to Section III to include details for the contact person. Input their name, title, address, state, zip code, email address, telephone number, and fax number.

- Review all the entered information for accuracy. Make sure that all sections have been completed fully.

- Once satisfied with the information, save your changes. You can also download or print the completed form if needed. Lastly, you can share the form according to your needs.

Complete your Form WR-30 online today to ensure timely and accurate reporting.

Related links form

The WR-30 form in New Jersey is an important document that reports employee withholding for state income tax. Employers use this form to provide the state with information about the income tax withheld from employees' paychecks. Understanding its significance can help ensure compliance and avoid penalties. If you need help managing this form, USLegalForms offers tools and templates to simplify the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.