Get Dss-ea-320 04/02 Self-employment Ledger - State.sd.us 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DSS-EA-320 04/02 SELF-EMPLOYMENT LEDGER - State.sd.us online

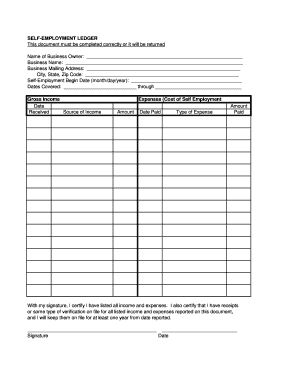

Completing the DSS-EA-320 04/02 self-employment ledger is an essential task for documenting your business income and expenses accurately. This guide provides step-by-step instructions to assist you in filling out the form effectively and ensuring that all required information is captured properly.

Follow the steps to accurately complete your self-employment ledger.

- Click ‘Get Form’ button to access the document and open it in the available editing tool.

- In the first section, enter your name as the business owner. This is important for identification purposes.

- Next, fill in the business name. Ensure that this matches your registered business name to avoid discrepancies.

- Enter your business mailing address, including the street address, city, state, and zip code. Accurate information is crucial for official correspondence.

- Complete the self-employment begin date by entering the month, day, and year you started your business. Use the format specified in the field.

- Fill in the dates covered for the report by indicating the range of dates your income and expenses are being reported. This ensures clarity on the reporting period.

- Document your gross income by providing the date received, source of income, and the corresponding amounts under the 'Gross Income' section.

- In the 'Expenses' section, record the date paid, type of expense, and amount paid for each cost of self-employment. Make sure to categorize each expense accordingly.

- Once all entries are made, review the information for accuracy. It's important to have all income and expenses listed correctly to avoid processing delays.

- Finally, sign and date the form to certify that all listed income and expenses are accurate and that you possess the necessary receipts or verification for one year from the reporting date.

- After thorough review and ensuring all required information is included, save any changes made to the document. You may download, print, or share the completed ledger as required.

Take action now and complete your DSS-EA-320 04/02 self-employment ledger online to ensure your records are accurate and up to date.

To show income as a self-employed individual, you can present various documents such as tax returns, profit and loss statements, and the DSS-EA-320 04/02 SELF-EMPLOYMENT LEDGER - State.sd. These documents illustrate your financial situation and provide clear proof of income. Ensure that you compile accurate and up-to-date records to enhance your credibility. This information is crucial for lenders or when applying for grants.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.