Loading

Get T3 Return Fillable 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T3 Return Fillable online

Filling out the T3 Return Fillable form online can seem daunting, but with clear guidance, you can complete it accurately and efficiently. This guide provides step-by-step instructions to help you navigate each section of the form with ease.

Follow the steps to complete the T3 Return Fillable form.

- Press the ‘Get Form’ button to access the T3 Return Fillable form. This action will allow you to download the form and open it in the editor.

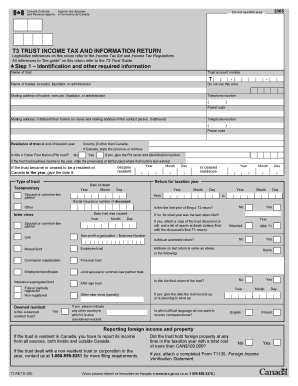

- Begin by filling in the identification and other required information. This includes the name of the trust, the trust account number, and details of the trustee, executor, liquidator, or administrator. Make sure to include their mailing address and contact details.

- Indicate the residence of the trust at the end of the taxation year. If applicable, state if it is a Yukon First Nation trust and provide relevant details regarding residency within Canada.

- Proceed to answer questions regarding the trust type and significant dates, such as the date the trust was created or if this is the first year filing a T3 return. Additionally, indicate if the trust had business income or if it's considered a deemed resident trust.

- Complete the section related to calculating the trust's total income. This includes reporting different types of income such as taxable capital gains, pension income, dividends from Canadian corporations, and more.

- Next, calculate the trust's net income by including all deductions allowed under the tax regulations. Carefully track all deductions to ensure accuracy.

- Calculate the taxable income, which includes any deductions applied to arrive at the final amount. Ensure this figure is accurately reflected to avoid any discrepancies.

- Summarize the total tax and credits. Add all taxes payable and subtract any applicable credits. This will yield the final balance that needs to be assessed.

- Complete the certification section. Ensure all required signatures are provided along with the date and contact information of the preparer.

- Finally, save your changes, download, print, or share your completed T3 Return Fillable form as needed. Make sure to keep a copy for your records.

Start completing your T3 Return Fillable online today for efficient and accurate filing.

Yes, trust distributions are generally considered taxable income for beneficiaries receiving them. When filling out your T3 Return Fillable, you must report these distributions accurately. This ensures that you meet your tax obligations and can take advantage of any applicable deductions or credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.