Loading

Get Soc 2298 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Soc 2298 online

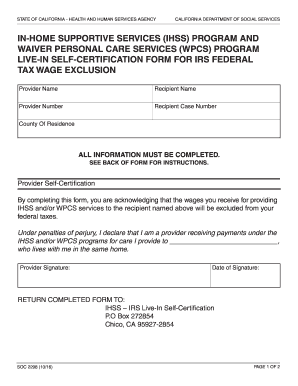

Filling out the Soc 2298 form online requires careful attention to detail. This guide will provide step-by-step instructions to assist you in completing the Live-In Self-Certification Form for IRS Federal Tax Wage Exclusion efficiently.

Follow the steps to successfully complete the Soc 2298 form online.

- Click the ‘Get Form’ button to access the Soc 2298 and open it in your preferred online editor.

- In the 'Provider Name' field, enter your name exactly as it appears on your IHSS paperwork.

- Locate your Provider Number on your IHSS documents and input it into the 'Provider Number' field.

- Find the Recipient Case Number in your IHSS documents and enter it in the designated 'Recipient Case Number' field.

- In the 'County of Residence' section, include the county where both you and the recipient reside.

- Review all completed sections to ensure accurate and clear information is provided.

- Affix your signature in the designated area and include the date you signed the form.

- Final steps include saving your changes, and you may choose to download, print, or share the completed form as needed.

Complete your Soc 2298 form online today to ensure you meet all requirements efficiently.

To get your tax form from IHSS, you can typically access it through your online account. If you prefer, you can also request it directly from your local IHSS office. Keeping track of your submissions related to SOC 2298 can help ensure that all your documents are in order. Remember to check for updates regularly so you don’t miss any crucial information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.