Get Insurance Needs Analysis Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Insurance Needs Analysis Template online

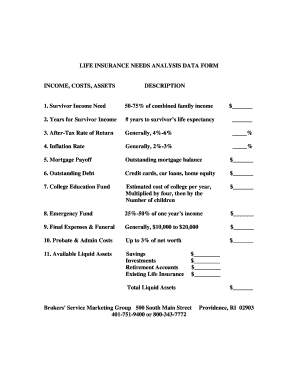

Filling out the Insurance Needs Analysis Template is a crucial step in understanding your financial needs for life insurance. This guide will walk you through the components of the form, ensuring that you provide accurate information tailored to your individual situation.

Follow the steps to complete your analysis effectively.

- Click ‘Get Form’ button to access the template in an editable format.

- Begin with the survivor income need. Estimate the required income by calculating 50-75% of your combined family income, and enter that amount in the corresponding field.

- Specify the number of years for the survivor’s income. This should reflect the years up until the survivor’s life expectancy. Enter the number in the provided field.

- Input the after-tax rate of return you expect on your investments, generally between 4% and 6%. Write the percentage in the designated area.

- Fill in the inflation rate, typically between 2% and 3%. This will help adjust future costs to current rates. Enter the percentage in the relevant field.

- Report your outstanding mortgage balance. This figure is essential to understand your existing debt obligations. Enter it in the appropriate space.

- List any outstanding debt including credit cards, car loans, and home equity. Provide the total amount in the given field.

- Calculate the estimated cost for your children's college education. Multiply the annual cost by four and then by the number of children you have. Enter that total in the relevant section.

- Determine the amount you want to allocate for an emergency fund, which should be 25%-50% of one year’s income. Input that amount in the provided area.

- For final expenses and funeral costs, generally consider a range of $10,000 to $20,000. Enter your estimate in the corresponding field.

- Assess any probate and administrative costs, which can be up to 3% of your net worth. Enter the appropriate amount in the designated space.

- List your available liquid assets, including savings, investments, retirement accounts, and existing life insurance, filling in each amount as it applies.

- Once all fields are completed and accurate, save your changes. You can download, print, or share the completed form as needed.

Begin completing your Insurance Needs Analysis Template online today to assess your financial protection needs.

Finding a prospect involves a mix of research and outreach strategies. You can start by exploring community events, utilizing social media platforms, and implementing targeted online advertisements. Incorporating the Insurance Needs Analysis Template can help you better understand potential clients' needs and create a compelling value proposition to connect with them effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.