Get Mnst3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mnst3 online

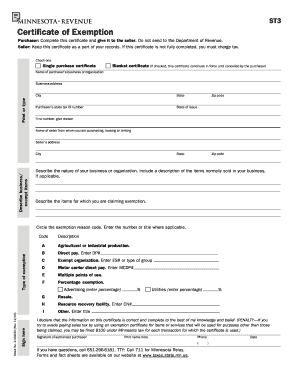

Completing the Mnst3 form online can seem challenging, but with step-by-step guidance, you can navigate it with ease. This form is crucial for claiming a certificate of exemption, ensuring that users can efficiently utilize tax benefits and comply with regulations.

Follow the steps to successfully fill out the Mnst3 form.

- Click the ‘Get Form’ button to access the Mnst3 form and open it in your preferred online editor.

- Begin by selecting whether you are submitting a single purchase certificate or a blanket certificate. If you choose the blanket certificate, note that it remains valid until canceled.

- Enter the name of the purchaser's business or organization, along with their business address, city, state, zip code, and state of issue. If applicable, provide a reason if no state tax ID number is available.

- Fill in the seller's name and address where you are purchasing, leasing, or renting the items. Be sure to include the correct city, state, and zip code.

- Describe the nature of your business or organization, including the items normally sold, as well as the items for which you are claiming exemption.

- For the exemption reason, circle the appropriate code and enter additional information as required. Make sure to thoroughly understand each exemption type, including agricultural, direct pay, and many others.

- Sign the form, print your name clearly, and provide a contact number. Ensure that all information is correct, as inaccuracies could lead to penalties.

- After completing the form, you can either save your changes, download the completed form, print it, or share it as needed.

Begin the process now and complete your exemption documents online!

Determining how many exemptions to withhold involves evaluating your overall income, tax situation, and financial goals. You want to avoid overpaying on your taxes while ensuring enough is withheld to cover your tax obligations. A visit to UsLegalForms can provide you with resources to accurately assess your needs and guidelines for filling out withholding forms efficiently. Make sure your choices align with current tax laws to optimize your withholdings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.