Loading

Get Juristic Crs Fnb 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Juristic Crs Fnb online

Filling out the Juristic Crs Fnb form is a necessary process for entities to ensure compliance with tax obligations. This guide provides a clear, step-by-step approach to completing the form online, helping users with varying levels of experience.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the Juristic Crs Fnb form and open it for editing.

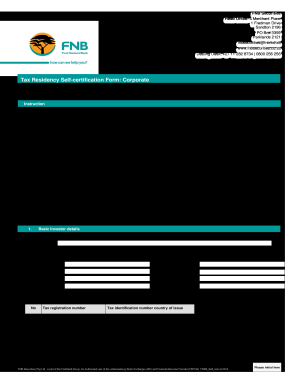

- In the Basic Investor Details section, accurately enter the registration name and registration number or Trust number if applicable. Ensure that the entity's physical address is complete, including details for care of, building name, street number, street or farm name, suburb or district, city or town, country, and postal code.

- Fill in the Tax Registrations/Obligations section. List all tax registration details for jurisdictions where the entity may have tax obligations. Be specific with tax registration numbers and the country of issue.

- If the entity is classified as a Financial Institution, complete the Financial Institutions section. Select the appropriate box that reflects the entity's status and provide the relevant Global Intermediary Identification Number (GIIN) if applicable.

- Address the Non-Financial Entities section if the entity is not a Financial Institution. Identify your FATCA classification and complete any additional questions regarding your financial status.

- In the Your Declarations section, confirm the accuracy of the information provided, the tax residence status, and any changes to this status. Ensure that all declarations are completed and understood.

- Complete Annexure A for all controlling persons if applicable. Provide details including full names, identity/registration numbers, relationships, and tax obligations as required.

- Once all sections are completed, review your form for accuracy. Save your changes, download the document, and prepare to print or share it as needed.

Begin filling out the Juristic Crs Fnb online today to ensure compliance with tax regulations.

A reportable jurisdiction person in CRS is an individual or entity that resides in a country that has an agreement to exchange tax information under CRA. These persons are required to be reported by financial institutions following the Juristic CRS FNB guidelines. Compliance with these standards is critical for maintaining your business reputation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.