Loading

Get Tax Chart 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Chart online

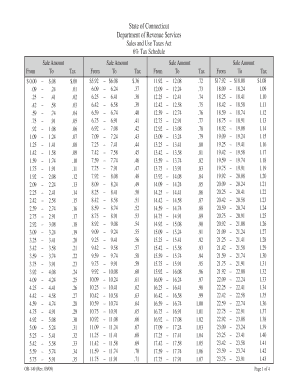

The Tax Chart is an essential document for calculating sales and use taxes in Connecticut. This guide will walk you through the process of filling out the Tax Chart online, ensuring you complete each section accurately.

Follow the steps to effectively fill out the Tax Chart online.

- Press the ‘Get Form’ button to access the Tax Chart. This action enables you to open the document for editing.

- Begin by locating the section labeled 'Sale Amount From'. Input the amount at which the sale occurs in the designated field, ensuring it falls within the provided ranges.

- Next, find the corresponding 'Sale Amount To' field. Here, you will specify the maximum limit for the sale amount, which helps determine the applicable tax.

- Consult the 'Tax' section to identify the appropriate tax value corresponding to your entered sale amounts. Ensure that the values align correctly to avoid discrepancies.

- Continue this process for all outlined ranges in the Tax Chart, ensuring that you repeat the steps for each range of sale amounts and their associated taxes.

- Once all fields are filled out accurately, you can save your changes. Choose the appropriate option to download or print the Tax Chart. You may also share the document as needed.

Complete the Tax Chart online today to ensure compliance with Connecticut's tax regulations.

The tax table for a single person outlines the specific tax rates applicable to individuals without dependents. This tax chart helps single filers understand their tax obligations based on varying income levels. By consulting this chart, you can better anticipate your tax dues and make necessary financial plans accordingly. For detailed assistance, consider using resources available at uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.