Get St 120 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-120 online

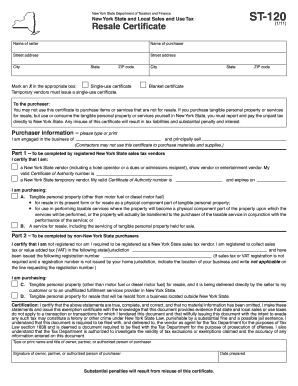

The ST-120 form is a resale certificate used for sales tax exemption in New York State. This guide provides a step-by-step approach for completing the form accurately while filing online, ensuring compliance with state requirements.

Follow the steps to complete the ST-120 form accurately.

- Click the ‘Get Form’ button to access the ST-120 form and open it in your preferred editor.

- Enter the seller's name and the purchaser's information, including the street address, city, state, and ZIP code. Ensure all details are accurate for proper identification.

- Indicate whether this is a single-use or blanket certificate by marking an X in the appropriate box. Note that temporary vendors should only select single-use.

- Under ‘Purchaser information,’ provide details about the nature of your business and the type of products or services being purchased for resale.

- Complete Part 1 if you are a registered New York State sales tax vendor. Include your valid Certificate of Authority number.

- If you are a non-New York State purchaser, fill out Part 2 and indicate your registration details with your home jurisdiction.

- Certify the information provided by typing or printing your name and title. Ensure you sign the form to validate the statements made.

- Finally, enter the date the form was prepared. After completing the required fields, you can save your changes, download, print, or share the completed ST-120 form as needed.

Complete your ST-120 and other necessary documents online to ensure a smooth filing process.

No, a resale certificate and an Employer Identification Number (EIN) serve different purposes. A resale certificate, like the ST 120, allows businesses to buy goods without paying sales tax for resale, while an EIN is a unique identifier used by the IRS for tax purposes. Both are crucial for business operations, but they are used in distinct contexts. To understand how to obtain either, visit the USLegalForms platform for valuable information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.