Loading

Get Anlage Kind

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Anlage Kind online

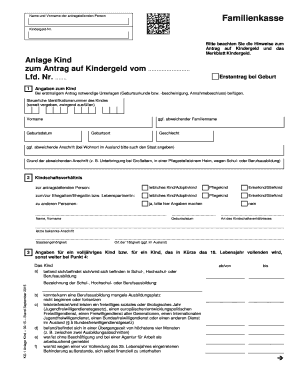

The Anlage Kind is an essential form for applying for child benefits in Germany. This guide provides a step-by-step breakdown of how to accurately complete the form online to ensure you receive the benefits you are entitled to.

Follow the steps to complete the Anlage Kind form online.

- Press the ‘Get Form’ button to access the Anlage Kind form and open it in your preferred online editor.

- Begin by entering your personal information including your full name, family name (if applicable), and Tax identification number.

- Provide details about the child for whom you are claiming benefits. This includes their first name, any different family name, birth date, and place of birth. Indicate the child’s gender and, if necessary, include any alternative address.

- Specify the relationship to the child. Select from options such as biological child, adopted child, foster child, grandchild, or stepchild. If the child’s relationship is with someone other than you, provide their details.

- If the child is over 18, include information about their education or employment status, noting if they are enrolled in school, vocational training, or are currently unemployed.

- Fill in details regarding any other contributions to child benefits in the last five years to ensure there are no duplicate claims.

- Complete the section regarding any child-related financial support received from agencies outside of Germany.

- If applicable, provide information regarding any previous employment or public service that you or the child might have had in the last five years.

- Once all fields are complete and reviewed, you may save your progress, download the form, print it, or share it as needed.

Start completing your Anlage Kind form online today for a smooth benefits application process.

An SSN is not required for filing the W-8BEN form if you are a foreign individual without a U.S. tax identification number. However, having an Individual Taxpayer Identification Number (ITIN) can be helpful to establish your identity for tax purposes. This is especially relevant when discussing certain benefits available under the Anlage Kind provision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.