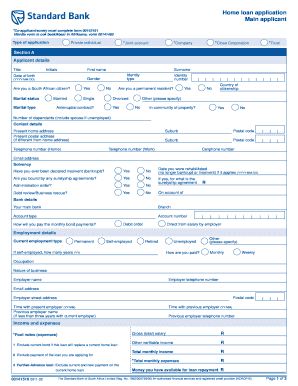

Get Standard Bank Business Loans 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Standard Bank Business Loans online

How to fill out and sign Standard Bank Business Loans online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience all the advantages of finishing and submitting legal documents online. Utilizing our platform to complete Standard Bank Business Loans will only take a few minutes. We enable this by providing you access to our feature-laden editor that can modify/correct a document's original text, incorporate special fields, and facilitate e-signing.

Complete Standard Bank Business Loans in merely a few clicks by following the suggestions below:

Submit the new Standard Bank Business Loans in an electronic format when you have finalized filling it out. Your information is securely protected as we adhere to the highest security standards. Join the many satisfied users who are already submitting legal forms from the comfort of their homes.

- Select the document template you need from the collection of legal form samples.

- Press the Get form button to access it and start making edits.

- Fill in all the necessary fields (they are highlighted in yellow).

- The Signature Wizard permits you to apply your electronic signature right after you've entered the details.

- Enter the date.

- Review the entire template to ensure you have filled in all the information and that no modifications are required.

- Click Done and download the completed form to your device.

How to Modify Get Standard Bank Business Loans 2020: Personalize Forms Online

Enjoy a stress-free and paperless approach to adjusting Get Standard Bank Business Loans 2020. Utilize our reliable online service and conserve significant time.

Creating each document, including Get Standard Bank Business Loans 2020, from scratch consumes too much energy, so employing a proven platform of pre-loaded document templates can greatly enhance your productivity.

However, altering them can be challenging, particularly for documents in PDF format. Fortunately, our vast resource includes an integrated editor that enables you to effortlessly fill out and modify Get Standard Bank Business Loans 2020 without leaving our site, saving you time on form completion. Here's what you can do with your form using our tools:

Whether you need to work with customizable Get Standard Bank Business Loans 2020 or any other form in our catalog, you are on the right path with our online document editor. It's user-friendly and secure and doesn't require specialized skills.

Our web-based solution is tailored to handle nearly everything imaginable in regard to file editing and completion. Move away from the traditional method of managing your forms. Select a more effective alternative to simplify your tasks and reduce paper dependency.

- Step 1. Locate the necessary document on our platform.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Utilize advanced editing tools that allow you to add, remove, annotate, and highlight or redact text.

- Step 4. Create and attach a legally-binding signature to your document using the signing feature from the upper toolbar.

- Step 5. If the document's layout doesn't fit your needs, use the tools on the right to delete, add more, and rearrange pages.

- Step 6. Include fillable fields so other individuals can be invited to complete the form (if relevant).

- Step 7. Distribute or send the document, print it, or choose the format in which you'd like to download the file.

Related links form

Choosing the right bank for business banking is essential for your financial success. Many entrepreneurs find that Standard Bank offers tailored services and resources that suit their specific needs. With robust online banking features, responsive customer service, and various account types, Standard Bank stands out in the business banking landscape. To make an informed choice, consider what services are most important for your business.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.