Loading

Get Irp6c - First Period For Companies Close Corporations - Form - 2005 - Services Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRP6c - First Period For Companies Close Corporations - Form - 2005 - Services Gov online

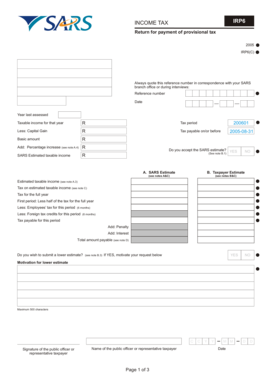

Filling out the IRP6c form for provisional tax payment is an essential task for companies and close corporations. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your IRP6c form online.

- Click ‘Get Form’ button to download the IRP6c form and open it in your preferred editor.

- Begin by entering your reference number, the date of submission, and the year last assessed in the designated fields. Ensure that these details are accurate for effective correspondence with the tax authority.

- In the 'Taxable income for that year' section, input the appropriate amount in Rand after deductions for any capital gains.

- Indicate the 'Tax period' and calculate the 'Tax payable on/or before' based on your estimated taxable income. This will allow you to understand your tax obligations for the specified period.

- Decide whether you accept the SARS estimate of your taxable income. If you disagree, you will need to provide your own estimate and any relevant motivation in the provided space.

- If applicable, enter your employee’s tax details and any foreign tax credits in the sections provided. This will ensure any applicable credits reduce your overall tax payable.

- Review your calculations for any penalty or interest that may be applicable, and sum these amounts to determine your total amount payable.

- Once you have completed all sections accurately, you may choose to save your changes, download your completed form, and print it for your records. If desired, you can also share the document with your tax advisor.

Complete your IRP6c form online today to ensure timely and accurate tax payments.

Yes, the IRS can pursue businesses for outstanding debts even after closure. If you have unpaid taxes or unfiled returns, the IRS may seek payment. It is vital to fulfill all tax obligations before closing your business to avoid future complications. Leveraging the IRP6c - First Period For Companies Close Corporations - Form - 2005 - Services Gov can help ensure compliance during this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.