Loading

Get Promissory Note With Balloon Payment Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Promissory Note With Balloon Payment Template online

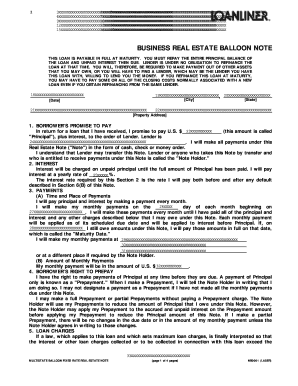

Filling out a promissory note with a balloon payment template can be straightforward when you know what each section entails. This guide provides you with clear instructions to help you complete the document efficiently and accurately.

Follow the steps to complete your promissory note successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by filling out the borrower's information in the designated fields, including the full legal name and the type of organization, if applicable.

- Enter the principal amount you are borrowing in the section labeled 'Borrower's promise to pay.' This is the total amount that will be paid, excluding interest.

- Specify the loan interest rate in the 'Interest' section. Ensure that the percentage is accurately presented.

- In the 'Payments' section, indicate the payment schedule by stating the date monthly payments will begin and the payment amount.

- Confirm your rights regarding principal prepayment in the 'Borrower's right to prepay' section. Acknowledge the conditions for making early payments.

- Review the 'Loan charges' section to understand any potential fees and be prepared to fulfill the repayment obligations outlined.

- If you anticipate any late payments, note the associated late charges under 'Borrower's failure to pay as required.'

- Fill in the addresses for notices in the 'Giving of notices' section, ensuring they are up-to-date.

- After completing all sections, make sure to review the document for accuracy, save your changes, and consider downloading or printing the completed form.

Get started on your digital document journey today by completing your promissory note online.

An example of a balloon note could be a home mortgage that has low monthly payments for five years, followed by a significant amount due at the end of that term. This structure provides initial financial relief but requires planning for that larger payment. A Promissory Note With Balloon Payment Template streamlines the creation of such a note, highlighting important details for the lender and borrower.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.