Get Property Return Slip Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Return Slip Form online

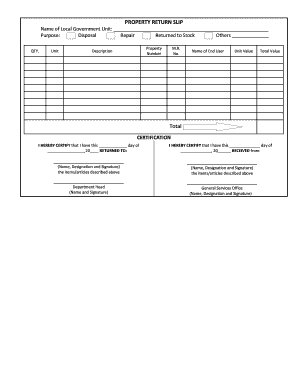

Completing the Property Return Slip Form online is a straightforward process that ensures accurate documentation of property transactions. This guide provides detailed steps to help you fill out the form efficiently and correctly.

Follow the steps to successfully complete the Property Return Slip Form.

- Click ‘Get Form’ button to obtain the Property Return Slip Form and open it in your preferred online editor.

- Fill in the 'Name of Local Government Unit' field with the relevant governmental body managing the property.

- Indicate the purpose for the property return by selecting one of the options: 'Disposal,' 'Repair,' or 'Returned to Stock.'

- In the 'QTY.' field, enter the quantity of items being returned.

- Specify the 'Unit' of measurement for the items, such as pieces or units.

- Input the 'Property Number' associated with each item for proper tracking.

- Provide a brief 'Description' of the items being returned to ensure clarity.

- Enter the 'M.R. No.' if applicable, to document any movement request number relevant to the transaction.

- If there are any additional notes or details, record them in the 'Others' section.

- Add the name of the 'End User' responsible for the items.

- Input the 'Unit Value' of each item, which is necessary for valuation purposes.

- Calculate and enter the 'Total Value' based on the quantity and unit value.

- In the certification section, date your entry at the time of return.

- Fill out the certification line where you will sign, including your name, designation, and signature.

- Ensure that the Department Head and General Services Office sections are completed with the appropriate signatures.

- Once all sections are completed, save your changes, download the form for your records, and print or share it as needed.

Complete your Property Return Slip Form online today for a seamless documentation experience.

In Texas, the business personal property tax exemption allows certain small businesses to avoid paying property taxes on their personal property. To qualify for this exemption, businesses often need to file a Property Return Slip Form detailing their assets and their value. This exemption can alleviate the financial burden for eligible businesses, allowing them to allocate resources to growth and investment. It is essential to verify eligibility and adhere to filing deadlines to benefit from this exemption.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.