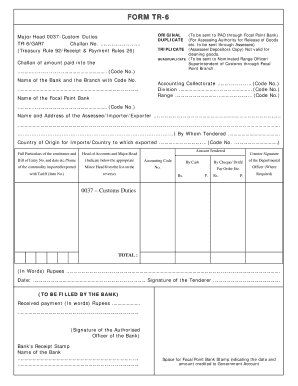

Get Tr 6 Challan For Customs Duty In Excel 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Tr 6 Challan For Customs Duty In Excel online

How to fill out and sign Tr 6 Challan For Customs Duty In Excel online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Regulatory, corporate, fiscal, and other electronic documents demand a higher level of adherence to laws and safeguarding. Our papers are refreshed frequently in line with the most recent changes in legislation.

Moreover, with our service, all information you incorporate in the Tr 6 Challan For Customs Duty In Excel is securely shielded from loss or damage via high-quality encryption.

Our platform allows you to handle the entire process of submitting legal documents online. Consequently, you save hours (if not days or weeks) and eliminate unnecessary expenses. From now on, complete the Tr 6 Challan For Customs Duty In Excel from your residence, workplace, or even while on the move.

- Access the document in our comprehensive online editor by clicking on Get form.

- Complete the required fields marked in yellow.

- Press the arrow labeled Next to navigate from one field to another.

- Utilize the e-autograph tool to insert an electronic signature into the template.

- Enter the appropriate date.

- Review the entire document to ensure that nothing has been overlooked.

- Click Done and save the updated document.

How to Update Get Tr 6 Challan For Customs Duty In Excel 2020: personalize forms online

Choose a trustworthy document editing service you can count on. Modify, execute, and verify Get Tr 6 Challan For Customs Duty In Excel 2020 securely online.

Frequently, altering forms, such as Get Tr 6 Challan For Customs Duty In Excel 2020, can pose difficulties, especially if you have them in a digital format yet lack access to specialized tools. Naturally, you can employ some alternatives to navigate around it, but you might end up with a form that fails to satisfy the submission standards. Utilizing a printer and scanner isn’t a viable solution either as it's time- and resource-intensive.

We provide a more seamless and efficient method for modifying forms. A thorough collection of document templates that are straightforward to edit and certify, and then render fillable for others. Our platform goes far beyond just a selection of templates. One of the greatest advantages of using our service is that you can alter Get Tr 6 Challan For Customs Duty In Excel 2020 directly on our site.

As it's a web-based solution, it prevents you from needing to download any software. Additionally, not all corporate policies allow you to install it on your work laptop. Here’s the simplest way to easily and securely manage your documents with our solution.

Forget about paper and other ineffective methods for completing your Get Tr 6 Challan For Customs Duty In Excel 2020 or other documents. Utilize our tool instead, which features one of the most extensive libraries of editable forms and a robust document editing capability. It’s simple and secure, and it can save you a significant amount of time! Don’t just take our word for it, give it a try yourself!

- Click the Get Form > and you’ll be immediately directed to our editor.

- Once opened, you can start the customization process.

- Choose checkmark or circle, line, arrow, and cross, among other options to annotate your form.

- Select the date field to insert a specific date into your document.

- Add text boxes, images, and notes, among others, to enhance the content.

- Utilize the fillable fields option on the right to include fillable {fields.

- Select Sign from the top toolbar to create and insert your legally-binding signature.

- Click DONE to save, print, and distribute or download the final product.

A remittance challan in SAP is a document used to record payments made to the government, often associated with tax obligations. This type of challan helps businesses maintain accurate records of their financial commitments in compliance with regulations. When filing customs duties, using a TR-6 challan for customs duty in Excel allows for efficient handling of your financial data.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.