Loading

Get How To Claim Pli Maturity Amount

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Claim Pli Maturity Amount online

Filing the How To Claim Pli Maturity Amount form online can seem challenging, but with the right guidance, you can complete it with ease. This guide will walk you through each step of the process, ensuring you provide all necessary information accurately.

Follow the steps to complete your claim for maturity amount.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

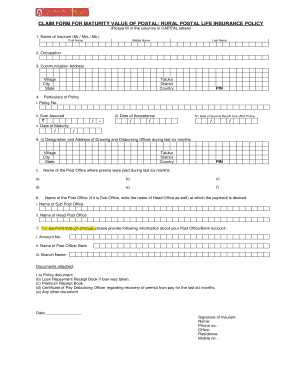

- Fill in your name as the insurant. Use capital letters for the first name, middle name, and last name. Select an appropriate title: Mr., Mrs., or Ms.

- Complete your communication address. Include your village, city, state, and postal PIN code.

- Provide details of the taluka, district, and country associated with your communication address.

- Enter the particulars of your policy including: policy number, sum assured, date of acceptance, survival benefit due date (for AEA policy), and date of maturity.

- Fill in the designation and address of the drawing and disbursing officer you interacted with during the last six months. Include details such as village, city, state, district, and postal PIN.

- List the name of the post office where premiums were paid over the last six months. Use separate entries for each post office if necessary.

- Specify the name of the post office where you wish to receive the payment. If applicable, provide details for both the sub post office and head post office.

- If opting for payment through cheque, fill in your account number and the name of the post office or bank. Include the branch name as well.

- Attach the required documents such as the policy document, loan repayment receipt book (if applicable), premium receipt book, and certificate of pay disbursing officer regarding premium recovery.

- Finally, sign and date the document. Provide your name and contact numbers for both office and residence, along with your mobile number.

- Once you have completed all sections, you can save your changes, download the filled form, print it out, or share it as needed.

Complete your document online today and ensure all your details are correctly submitted for a smooth claiming process.

You can check your PLI maturity amount online or through your post office. The India Post website provides an option for policyholders to track their policy details. Alternatively, visiting your local post office can also give you direct access to your policy information. This way, you can stay informed about your maturity amount and claim process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.