Loading

Get Form 35

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 35 online

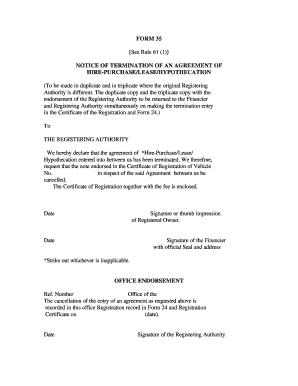

Filling out Form 35 online is a straightforward process that allows users to officially terminate a hire-purchase, lease, or hypothecation agreement. This guide provides step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the Form 35 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Provide the name of the Registering Authority to whom the notice is addressed at the beginning of the form.

- In the declaration section, clearly state that the agreement of hire-purchase, lease, or hypothecation between the involved parties has been terminated.

- Include the details of the vehicle in question by entering the Vehicle Number associated with the agreement.

- Indicate the date on which the termination notice is being submitted.

- Have the Registered Owner either sign or provide their thumb impression in the designated area.

- Next, the Financier must sign the form and add their official seal and address.

- Make sure to strike out any sections that do not apply to your agreement.

- If required, complete additional endorsements or signatures as specified in the instructions for submission.

- After filling out the form, save your changes and ensure that you have the option to download, print, or share the completed form as necessary.

Complete your documents online today for a streamlined process.

Filing a faceless appeal entails submitting your appeal digitally, without the requirement for personal appearances during the proceedings. This method promotes transparency and efficiency in the resolution of tax disputes. Utilizing platforms like uslegalforms can help streamline the filing process by providing resources and templates tailored for faceless appeals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.