Get 80g Certificate Pdf 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 80g Certificate Pdf online

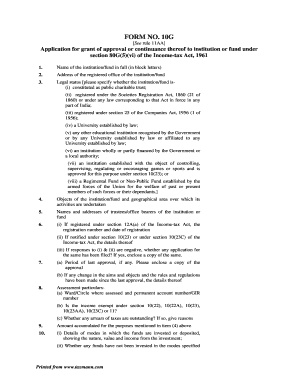

Filling out the 80g Certificate Pdf online is a crucial step for institutions seeking approval under section 80G(5)(vi) of the Income-tax Act, 1961. This guide will walk you through the necessary components of the form, ensuring a clear understanding of each section and its requirements.

Follow the steps to complete the 80g Certificate Pdf online

- Click the ‘Get Form’ button to obtain the 80g Certificate Pdf and open it in your chosen online editor.

- In the first field, enter the name of the institution or fund in full, using block letters to ensure clarity.

- Provide the address of the registered office of the institution or fund in the designated section.

- Specify the legal status of the institution or fund, choosing from the options provided, such as public charitable trust or registered under the Societies Registration Act.

- Outline the objects of the institution or fund and identify the geographical area in which its activities are conducted.

- List the names and addresses of the trustees or office bearers associated with the institution or fund.

- If applicable, include the registration number and date under section 12A(a) of the Income-tax Act, and mention if notified under section 10(23) or section 10(23C).

- Indicate the period of last approval and any changes that occurred since this approval, including updates to aims and objects as well as rules and regulations.

- Provide assessment particulars such as the Watt/circle where assessed and any outstanding taxes.

- Detail the amount accumulated for the purposes outlined previously, explaining investment modes and any funds not invested as specified.

- Describe whether the institution or fund is engaging in business, including details if applicable, and its relation to the objects of the organization.

- Outline any non-cash contributions received, their nature, quantity, value, and the manner of their utilization.

- Provide details of shares, security, or other property purchased from interested persons as specified in section 13.

- Clarify if any part of the income or property has conferred benefits to interested persons, detailing the nature of these benefits.

- Lastly, certify the accuracy of the information provided by signing and including your designation, address, and the date.

- Save your changes, then download, print, or share the completed form as needed.

Complete your 80g Certificate Pdf online today to secure your institution's tax-exempt status.

Similar to determining the coverage type, the 80G Certificate Pdf issued by the charitable organization will clarify whether the donation qualifies for 100% or 50% deduction. Look for the details on the certificate, as this information is crucial for your tax filing. Ensuring you have the correct 80G Certificate Pdf at hand allows you to maximize your deductions effectively while doing your part for charity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.