Loading

Get Form 10i

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 10i online

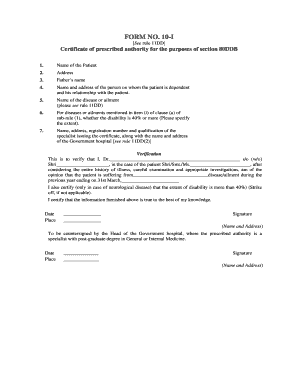

Filling out Form 10i is a crucial step for obtaining a certificate of prescribed authority under section 80DDB. This guide will walk you through the necessary steps to complete the form accurately and efficiently online.

Follow the steps to complete Form 10i successfully.

- Click ‘Get Form’ button to obtain the form and open it for editing online.

- Enter the name of the patient in the designated field. Ensure the name matches official documents for accurate processing.

- Provide the patient’s address in the corresponding section. Double-check the address for correctness to avoid delays.

- Fill in the father's name of the patient in the next field, as this information is required for identification.

- In this section, offer the name and address of the person on whom the patient is dependent, along with their relationship to the patient. This helps establish the support network.

- Specify the name of the disease or ailment as outlined in rule 11DD. Accurate descriptions are vital for eligibility.

- Indicate if the disability is 40% or more for diseases mentioned in item (i) of clause (a) of sub-rule (1). Be precise in your specifications.

- Provide the name, address, registration number, and qualifications of the specialist issuing the certificate. Include the name and address of the government hospital as per rule 11DD(2).

- In the verification section, the issuing doctor must sign and confirm that the provided information is accurate based on their examination and the patient’s history.

- The head of the government hospital must countersign the document if applicable. Ensure all signatures are dated and placed correctly.

- After completing and verifying all sections, users can save changes, download, print, or share the form as needed.

Start completing your Form 10i online now for a smoother experience.

Determining how many exemptions to withhold can depend on your financial situation, including your income and family status. Claiming too many exemptions may result in under-withholding, which can lead to tax owed at the end of the year. It's best to evaluate your tax liability based on recent income and expenses to make an informed decision. US Legal Forms provides calculators and forms to aid you in calculating the right number of exemptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.