Loading

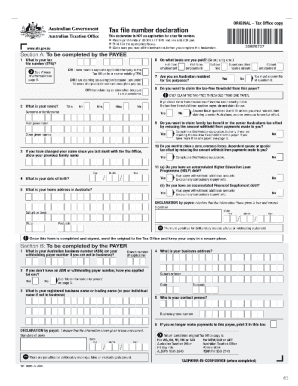

Get Tax Declaration Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Declaration Form online

Filling out the Tax Declaration Form online can seem challenging, but with the right guidance, it can be a straightforward process. This guide will walk you through each step to ensure that you complete your form accurately and efficiently.

Follow the steps to fill out your Tax Declaration Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reviewing the personal information section. Enter your full name, address, and contact information accurately, ensuring there are no typos.

- Next, provide your Social Security number or Tax Identification number in the designated field. This information is crucial for accurately processing your tax declaration.

- Move on to the income details section. Here, list all sources of income, including wages, interest, and investment income. Ensure to aggregate amounts correctly and include additional documentation if necessary.

- Proceed to the deductions section. Carefully review available deductions and credit options. Fill in the fields accurately, and attach supporting documents if required.

- Complete the section on tax liability. Calculate your total tax owed, considering any credits applied. Take your time to ensure accuracy.

- Finally, review the entire form for completeness. Check for any errors or omissions. Once satisfied, save changes, download or print the form, and follow any additional instructions for submission.

Complete your Tax Declaration Form online today to ensure timely processing and compliance.

Yes, you can look up tax forms online easily. Most government websites, including the IRS, have intuitive search features to find the tax declaration form and other necessary documents. Resources like USLegalForms offer a more guided experience, ensuring you quickly access what you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.