Loading

Get L8 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the L8 Form online

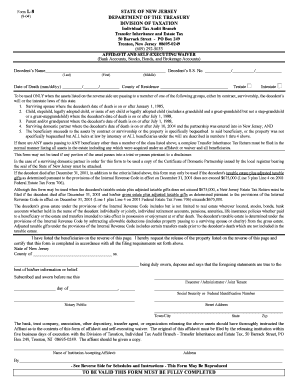

Filling out the L8 Form online can simplify the process of managing inheritance and estate tax. This guide provides a clear, step-by-step approach to help you accurately complete the form while ensuring all requirements are met.

Follow the steps to successfully complete your L8 Form online.

- Click ‘Get Form’ button to access the document and open it in your preferred online editor.

- Provide the decedent's name, including last, first, and middle names, as well as their Social Security number and date of death in the specified formats.

- Indicate the county of residence of the decedent and specify whether they passed away testate (with a will) or intestate (without a will).

- Complete the section for beneficiaries, ensuring compliance with the outlined criteria, and listing anyone who qualifies under the relevant categories.

- If applicable, attach any required documentation, such as the domestic partnership certificate if claiming assets as a domestic partner.

- Fill in the comprehensive details about the properties on the reverse side, including the market value at the date of death and the name of each beneficiary along with their relation to the decedent.

- Review the completed form carefully, ensuring all sections are filled out accurately and thoroughly.

- Once everything is complete, save your changes, and download or print the form for submission. Ensure you provide a copy to the releasing institution.

Take the first step today by filling out your L8 Form online.

A New Jersey inheritance tax waiver is a crucial document confirming that no taxes are owed on an inherited estate. It is essential for beneficiaries as it validates that they can legally receive their inheritance without tax liability. Seeking guidance on the L8 form will help you navigate this process seamlessly. This waiver is vital to ensure smooth asset transfer and compliance with state laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.