Loading

Get Tc 301 Utah Pdffiller 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 301 Utah Pdffiller online

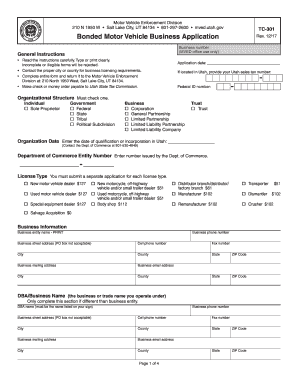

Filling out the Tc 301 form for Utah's Motor Vehicle Enforcement Division can be straightforward with the right guidance. This guide offers clear and step-by-step instructions for each section of the form, ensuring you complete it accurately online.

Follow the steps to fill out the Tc 301 form seamlessly.

- Click the ‘Get Form’ button to access the Tc 301 online form and open it in your editor.

- Indicate your organizational structure by checking the appropriate box, such as Individual, Government, Business, or Trust.

- Enter the date of qualification or incorporation in Utah in the 'Organization Date' field.

- Provide your Department of Commerce Entity Number in the designated section.

- Select the appropriate license type from the options provided and note any applicable fees.

- Fill out your business information, including entity name, address, phone numbers, email address, and other necessary details.

- Complete the DBA (Doing Business As) section, if applicable, providing the trade name and corresponding business details.

- List all owners or partners' information as required, ensuring to include the necessary details such as names, titles, contact information, and any citizenship status.

- Detail each owner's employment history for at least five years and their licensing history concerning motor vehicle sales or related fields.

- Answer questions regarding any criminal charges or probation periods, if applicable, ensuring full disclosure.

- If you are a franchise dealer, fill out the franchise section with applicable manufacturer or distributor details.

- Specify any special plates or decals required, calculating the handling fees associated with your order.

- Gather the required signatures from all owners, certifying the accuracy of the information provided.

- Finally, review all entered details for accuracy and completeness before saving your changes, downloading, printing, or sharing the filled-out form.

Complete your documents online with ease today!

Any partnership that conducts business in Utah must file a Utah partnership return, typically using Form TC 65. If your partnership generates income or has property in the state, filing is necessary, regardless of where the partners reside. Using tools like the TC 301 Utah Pdffiller can assist partners in meeting their filing obligations by requesting extensions when necessary. UsLegalForms can help you navigate this requirement seamlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.