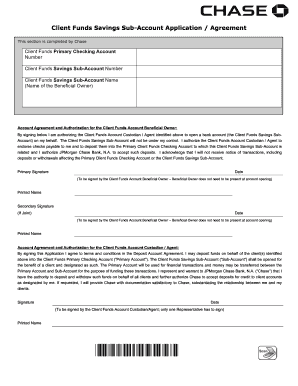

Get Client Funds Savings Sub-account Application Agreement 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Client Funds Savings Sub-Account Application Agreement online

Filling out the Client Funds Savings Sub-Account Application Agreement online is a straightforward process that allows users to establish a savings sub-account efficiently. This guide will provide clear instructions on each section of the form to ensure that you complete it accurately and comprehensively.

Follow the steps to complete the application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the first section, which is meant for Chase. This section includes the client funds primary checking account number and the client funds savings sub-account number.

- Next, provide the client funds savings sub-account name by entering the name of the beneficial owner in the appropriate field.

- Move on to the account agreement and authorization section. Here you will authorize the Client Funds Account Custodian/Agent to open a bank account on your behalf and endorse checks if necessary. Ensure you provide two signatures if the account is joint - one for the primary and one for the secondary account holders.

- Complete the information sections for both the primary client and any secondary client if applicable. This involves entering client names, tax IDs, citizenship status, current addresses, and phone numbers.

- Indicate if the client is tax responsible, and fill in the date of birth as required. There are also sections regarding military status, employer, and occupation information to complete.

- If the client is a business rather than an individual, complete the corresponding sections that require the legal business name, tax ID, business organization status, and address details.

- Lastly, review all the information entered for accuracy before proceeding to save your changes. You can download, print, or share the completed form as needed.

Complete your Client Funds Savings Sub-Account Application Agreement online today!

A client funds savings sub-account is a dedicated account for holding client funds in a secure and organized manner. This type of account often comes with specific features aimed at ensuring compliance and transparency. With the Client Funds Savings Sub-Account Application Agreement, you can effortlessly manage clients’ savings while ensuring their interests are protected.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.