Loading

Get Bt111 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bt111 Form online

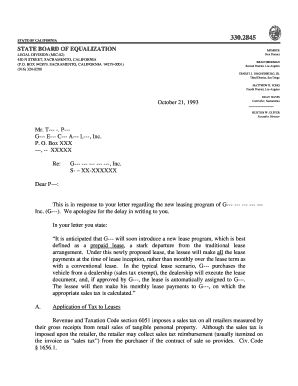

Filling out the Bt111 Form online is a straightforward process that requires attention to detail to ensure accuracy. This guide will provide you with step-by-step instructions to help you complete the form effectively while addressing any potential questions you may have.

Follow the steps to fill out the Bt111 Form online:

- Click the 'Get Form' button to obtain the form and open it in your chosen editor.

- Begin by entering your full name in the designated field. Be sure to use your legal name as it appears on official documents.

- Input your contact information, including your address, city, state, and zip code. Make sure that this information is current and correct.

- Fill in the section for vehicle information. This includes details such as the vehicle identification number (VIN), make, model, and year.

- If applicable, indicate whether you have previously paid sales or use tax on this vehicle. This is crucial for determining any credits that may apply.

- Complete the section regarding previous tax payments. List any corresponding amounts and provide necessary documentation if applicable.

- Review all entered information for completeness and accuracy. Ensure no fields are left blank unless they are not applicable.

- Once all information is filled out, save your changes. You may also choose to download the form for your records, print it, or share it with relevant parties.

Complete the Bt111 Form online today to ensure timely processing of your tax exemption!

Filling out the California resale certificate form requires inputs about your business and the items intended for resale. You must clearly specify the items being purchased without sales tax, and include relevant information such as your seller's permit number. That’s where the Bt111 Form comes into play, enabling businesses to effectively document their resale activities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.