Loading

Get St125 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St125 online

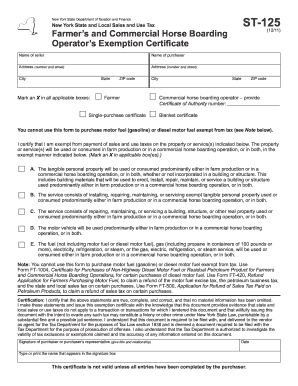

The St125 form is essential for farmers and commercial horse boarding operators to claim sales and use tax exemptions. This guide provides clear instructions on how to complete the St125 online, ensuring that users can easily navigate each section and field of the form.

Follow the steps to fill out the St125 online effectively.

- Click ‘Get Form’ button to obtain the St125 form and open it in the editor for completion.

- Enter the name of the seller in the designated field. Ensure that it is spelled correctly, as this information is vital for tax records.

- Fill in the name of the purchaser in the appropriate section. This must be the individual or entity claiming the exemption.

- Provide the address of the purchaser, including the street address, city, state, and ZIP code. Accuracy is crucial for any correspondence related to the form.

- Indicate whether the exemption is for a single purchase or if a blanket certificate is being issued by marking an X in the corresponding box.

- Select the applicable category or categories by marking an X next to the services or tangible personal property relevant to farm production or commercial horse boarding.

- If applicable, provide the Certificate of Authority number for the commercial horse boarding operation.

- Review all entries to confirm that they are complete, accurate, and free of any omissions.

- The purchaser or their representative must sign and date the form, confirming the accuracy of the information provided.

- After completing the form, save the changes. You can then download, print, or share the form as needed.

Complete your St125 form online today to ensure you claim your tax exemptions efficiently.

Yes, North Carolina does have a sales tax exemption certificate. This certificate allows qualifying buyers to make purchases without paying sales tax. To ensure you obtain the correct documentation and understand your status, consider consulting resources like USLegalForms to assist you with the St125.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.