Loading

Get Rut 25 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rut 25 Form online

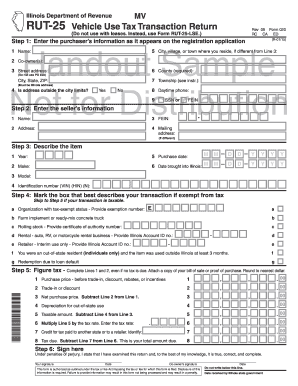

Filling out the Rut 25 Form online is essential for reporting vehicle use tax in Illinois. This guide will provide clear, step-by-step instructions to help users accurately complete each section of the form.

Follow the steps to complete the Rut 25 Form online.

- Click ‘Get Form’ button to obtain the Rut 25 Form and open it in the editor.

- Begin by entering the purchaser’s information as it appears on the registration application. Fill in the name, co-owner(s) if applicable, street address (ensuring it is not a PO Box), city, village or town, county, township, and daytime phone number. Also, indicate whether the address is outside the city limits and provide the Social Security Number or Federal Employer Identification Number (FEIN).

- Next, enter the seller’s information, which includes the seller's name, address, and FEIN. If the mailing address is different from the physical address, make sure to provide that information as well.

- In this section, describe the vehicle being purchased. Enter the year, make, model, and vehicle identification number (VIN). Additionally, provide the purchase date and the date the vehicle was brought into Illinois.

- Mark the box that applies to your transaction if it is exempt from tax, providing any necessary exemption numbers or IDs as indicated. If your transaction is taxable, skip to the next section.

- Calculate the tax by completing Lines 1 and 2. Attach a copy of your bill of sale or proof of purchase. You will need to subtract any trade-ins or discounts to find the net purchase price, apply depreciation if applicable, and calculate the taxable amount. Finally, multiply the taxable amount by the applicable tax rate and subtract any credits for taxes paid to another state.

- At the end of the form, users must sign and date the document. Ensure that both the purchaser and any co-owners provide their signatures and dates.

- Once the form is completed, save any changes, download a copy if necessary, print it for your records, or share it as needed.

Complete your Rut 25 Form online today for a smooth submission process.

In Illinois, sales tax exemptions usually apply to non-profit organizations, government agencies, and certain purchases necessary for production. Additionally, specific industry sectors may qualify for exemptions to promote economic growth. To ensure you are eligible for these exemptions, it's advisable to review the regulations or seek guidance. The Rut 25 form is instrumental for those who qualify, providing a clear path to tax savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.