Loading

Get St30

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST30 online

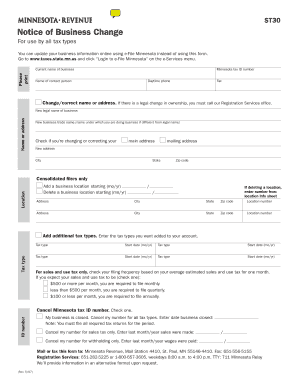

The ST30 form, also known as the Notice of Business Change, is essential for updating business information related to various tax types. This guide provides step-by-step instructions on how to effectively fill out the ST30 online, ensuring users can complete the process accurately and efficiently.

Follow the steps to complete the ST30 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the current name of your business and your Minnesota tax ID number in the appropriate fields.

- Provide the name of the contact person, their fax number, and a daytime phone number for future communication.

- Indicate any changes or corrections to your business information. If there is a legal change in ownership, please contact the Registration Services office directly.

- If you are changing or correcting your main address or mailing address, check the appropriate boxes and fill in the new address details including city, state, and zip code.

- For consolidated filers, indicate any new business locations you are adding or deleting, including start dates and location numbers as necessary.

- If applicable, add any additional tax types and specify their respective start dates.

- For sales and use tax, check the appropriate filing frequency based on your average estimated sales.

- If you need to cancel your Minnesota tax ID number, select the appropriate option and provide the closure date or last month/year sales were made as required.

- Once you have filled out all necessary fields, review your entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete the ST30 online now to ensure your business information is up to date.

To change the name associated with your IRS files, you should submit Form SS-5, Application for a Social Security Card, if it's related to your Social Security name. For other records, it's best to contact the IRS directly. Using uslegalforms, you can find the necessary forms and guidance to ensure your changes are processed smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.