Loading

Get Credit Application 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Application online

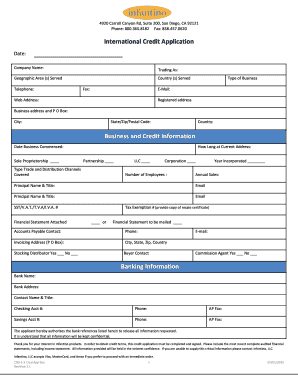

Completing the Credit Application online is a straightforward process designed to help users obtain credit terms efficiently. Follow this guide for a step-by-step approach to filling out the necessary fields accurately.

Follow the steps to complete your Credit Application successfully.

- Press the ‘Get Form’ button to obtain the application form and open it in your browser.

- Enter the date in the designated field. This marks the application date and is important for record-keeping.

- Complete the 'Company Name' section with the full legal name of your business, ensuring correctness for identification purposes.

- Fill in the 'Trading As' section if your business operates under a different name than the registered name.

- Select the geographic areas and countries served by your business to provide context for your market reach.

- Input the 'Telephone' and 'Fax' numbers for easy communication regarding your application.

- Provide your email address and web address if applicable, which will be used for communication and verification.

- Complete the 'Business and Credit Information' section by indicating when your business commenced and selecting the appropriate business structure (e.g., Sole Proprietorship, Partnership, LLC, Corporation). Include the number of employees and annual sales.

- Enter the principal contacts’ names, titles, and emails in the designated fields to facilitate communication.

- Indicate if a financial statement is attached or if it will be mailed later. Include tax exemption paperwork if relevant.

- Fill in 'Banking Information' with your bank's name, address, and contact information, along with account numbers.

- Complete the 'US Trade References' section with details of suppliers and accounts payable contacts to establish credit history.

- Review the terms and conditions carefully, acknowledging your understanding by providing initials in the specified section.

- Sign and date the application in the designated areas to authorize the information provided, affirming its accuracy.

- Once completed, save your changes, download the document, or print it for submission.

Complete your Credit Application online today to secure your desired credit terms!

The fastest way to reach a 700 credit score involves a multi-faceted approach. Begin by paying off outstanding debts, particularly those that are past due. Regularly check your credit report for mistakes and take immediate action to correct them. Utilizing a focused credit application can help you establish solid credit habits quickly, giving you the best chance for improvement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.