Get Repossession 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Repossession online

Filling out the Repossession form online can seem daunting, but with clear guidance, you can navigate the process with confidence. This comprehensive guide will help you understand each component of the form and provide step-by-step instructions for accurately completing it.

Follow the steps to complete your Repossession form online.

- Press the ‘Get Form’ button to acquire the Repossession document and open it in your preferred editing tool.

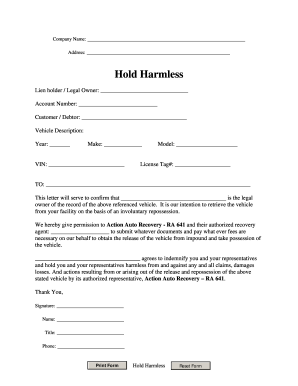

- Begin by entering the company name and address at the top of the form. Ensure all details are accurate and spelled correctly.

- In the 'Lien holder / Legal Owner' section, provide the name of the individual or entity that holds the lien on the vehicle. Fill in the accompanying 'Account Number' field.

- Input the 'Customer / Debtor' information, which includes the name of the person from whom the vehicle is being repossessed.

- Complete the 'Vehicle Description' section by providing the year, make, model, VIN, and license tag number of the vehicle being repossessed.

- In the designated area for the recipient, input the specific entity or dealer from whom you are retrieving the vehicle.

- Complete the statement confirming legal ownership and intention to retrieve the vehicle. Ensure this is clearly stated.

- Fill in the name of the authorized recovery agent who will be retrieving the vehicle on your behalf.

- Sign the form in the specified area. Remember, online you may not be able to input your signature directly; ensure to sign it physically later.

- After confirming all fields are filled out accurately, print the form for submission. You may need two identical forms for both the police department and towing agency.

- Attach the necessary documents, including a copy of the title and contract, and prepare to fax everything to the designated number provided.

- Save any changes made to the form and ensure you have access to a copy for your records before faxing the completed forms.

Take action now and complete your Repossession documents online for a smoother process.

The lifecycle of a repossession starts with the borrowing agreement, followed by missed payments and communication from the lender. Once repossession occurs, the asset is either sold at an auction or retained by the lender. This cycle can impact credit scores and financial stability, so early intervention is crucial. Staying informed can help you manage your financial health more effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.