Get Rut 25 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rut 25 online

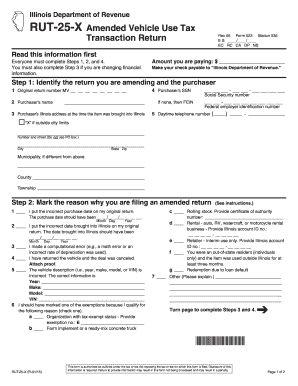

Filing the Rut 25 form online is an essential process for individuals who need to amend their vehicle use tax transaction. This guide provides clear and detailed instructions to help you easily navigate through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to fill out the Rut 25 online.

- Click ‘Get Form’ button to obtain the Rut 25 form and open it in the editor.

- Identify yourself by providing your motor vehicle (MV) number from the original return, your name, Social Security number (or federal employer identification number), co-owner’s name if applicable, and your address at the time of purchase.

- Mark the reason why you are filing an amended return by checking the appropriate box that explains your reason, such as an incorrect purchase date or computational error.

- Correct your financial information by rewriting the required figures in the specified columns for the purchase price, trade-ins, and other financial details. Make sure to round to the nearest whole dollar.

- Sign the form under penalties of perjury, indicating that the information you provided is true and complete. Ensure that both the primary user and any co-owner sign and date the document.

Complete your Rut 25 form online today to ensure compliance and avoid penalties.

Get form

Exemption qualifications can vary widely but typically include nonprofits, government entities, and specific low-income individuals. Each category has distinct criteria that must be met, such as maintaining proper documentation or applying through official channels. Understanding these rules is vital to ensure you take full advantage of available tax benefits, including those related to Rut 25.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.