Loading

Get Up Vat Challan Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Up Vat Challan Form online

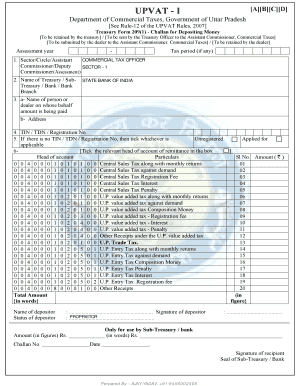

The Up Vat Challan Form is essential for depositing various taxes in Uttar Pradesh. This guide will provide you with clear and concise instructions on how to fill out the form online effectively.

Follow the steps to complete the Up Vat Challan Form online.

- Click the ‘Get Form’ button to obtain the Up Vat Challan Form and open it in your document editor.

- Enter the 'Assessment year' and 'Tax period' if applicable. This information is crucial for accurate tracking of your tax obligations.

- Specify the 'Commercial Tax Officer' by selecting the appropriate sector, circle, assistant commissioner, or deputy commissioner.

- Select the name of the treasury, sub-treasury, or bank where the payment will be made. For instance, you might choose the State Bank of India.

- Fill in the name of the person or dealer on whose behalf the amount is being paid, along with their address.

- Provide the TIN, TDN, or registration number in the designated field. If the user does not have one, tick the 'Unregistered' option.

- Tick the relevant head of account for the remittance, making sure to select the correct option that corresponds to the type of payment being made.

- State the total amount being deposited in both figures and words to avoid any discrepancies.

- Sign the form where indicated to validate the information provided and confirm the accuracy of the details.

- Once all the fields are completed, you can save the changes, download, print, or share the completed form as needed.

Complete your Up Vat Challan Form online today for a smooth tax payment process.

You can definitely submit VAT returns online. Many jurisdictions support digital submissions through their official websites or through reliable services like uslegalforms. Make sure to complete your Up Vat Challan Form with accurate information to ensure a smooth submission process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.