Loading

Get Tsp Form 99 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tsp Form 99 online

This guide provides clear and detailed instructions on how to complete the Tsp Form 99 online. By following these steps, users can ensure they fill out the form accurately and efficiently, facilitating the withdrawal process from their Thrift Savings Plan account.

Follow the steps to complete the Tsp Form 99 online

- Press the ‘Get Form’ button to access the Tsp Form 99 online and open it in the digital editor.

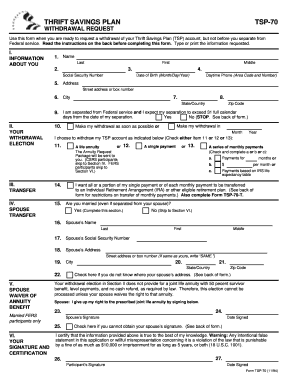

- Enter your personal information in Section I. Fill in your name, Social Security number, date of birth, and daytime phone number.

- Provide your complete address including street address, city, state, and zip code.

- In Section I, confirm your eligibility by checking the box stating that you are separated from Federal service and that your separation will exceed 31 full calendar days.

- Move to Section II and select one of the options regarding your withdrawal election: a life annuity, a single payment, or a series of monthly payments.

- If choosing a series of monthly payments, specify the number of months or the dollar amount you wish to receive monthly.

- In Section III, indicate whether you wish to transfer a portion of your payment to an IRA or other eligible retirement plan.

- If applicable, complete the spouse information in Section IV, providing their name, Social Security number, and address.

- If required, ensure your spouse waives the right to a joint life annuity by obtaining their signature in Section V.

- Finally, in Section VI, sign and date the form to certify that all information provided is accurate. Save your changes, then download, print, or share the completed form as necessary.

Complete your Tsp Form 99 online today for a smooth withdrawal process.

The beneficiary of your TSP annuity is typically whichever individual you designate on your TSP account. This is crucial information captured on TSP Form 99. Keeping this beneficiary designation up to date ensures your intended recipient gets the benefits without delay. Regularly review your beneficiary choices to align them with your current life situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.