Loading

Get Cpt30 Form 2020 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cpt30 Form 2020 online

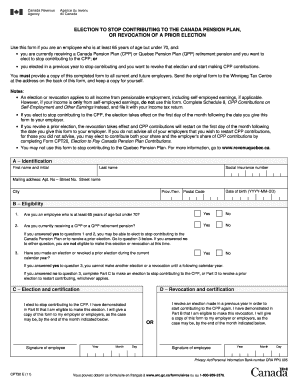

Filling out the Cpt30 Form 2020 is an important step for individuals aged 65 to 70 who wish to manage their contributions to the Canada Pension Plan. This guide will walk you through the process of completing the form online in a clear and supportive manner.

Follow the steps to confidently fill out the Cpt30 Form 2020.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the identification section by providing your last name, first name and initial, social insurance number, mailing address, and date of birth.

- Proceed to the eligibility section. Answer the questions regarding your age and whether you are currently receiving a CPP or QPP retirement pension. Ensure you understand that if you answered no to any eligibility questions, you may not be able to proceed.

- If eligible, move on to complete either Part C for electing to stop contributing to the CPP or Part D for revoking a previous election. Make sure to sign and date the appropriate section.

- Review all provided information for accuracy. Once confirmed, save your changes as required.

- After completing the form, download and print the document. Make copies to provide to any current or future employers.

- Send the original completed form to the Winnipeg Tax Centre at the provided address. Keep a copy for your records.

Begin completing your Cpt30 Form 2020 online today to manage your Canada Pension Plan contributions effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

As of 2023, if you earn less than the earnings ceiling, there will be no further rate increases for you. The CPP contribution rate will stay at 5.95% for employers and employees and at 11.9% for people who are self-employed, unless their earnings rise higher than the earnings ceiling.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.