Loading

Get 0619e Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 0619e Form online

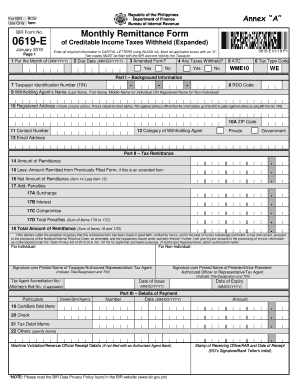

Completing the 0619e Form online is an essential step for taxpayers in ensuring accurate remittance of creditable income taxes withheld. This guide provides clear and comprehensive instructions to help users navigate the form effectively.

Follow the steps to fill out the 0619e Form accurately

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Enter the month and year of the form submission in the 'For the Month of (MM/YYYY)' field.

- Specify the due date for the payment in the 'Due Date (MM/DD/YYYY)' field.

- Indicate if this is an amended form by selecting 'Yes' or 'No' in the 'Amended Form?' section.

- State whether any taxes have been withheld by selecting 'Yes' or 'No' in the appropriate field.

- Fill in the 'ATC' (Applicable Tax Code) as well as the 'Tax Type Code' in the next fields.

- In Part I – Background Information, enter your Taxpayer Identification Number (TIN) followed by the RDO Code.

- Provide your withholding agent’s name including last name, first name, and middle name if applicable.

- Complete the registered address field accurately, including your ZIP code and contact number.

- Identify the category of withholding agent (Private or Government) and enter your email address.

- In Part II – Tax Remittance, input the amount of remittance you are submitting.

- If this is an amended form, enter any previously remitted amount in the appropriate field.

- Calculate the net amount of remittance by deducting any previously filed remitted amount from your current remittance.

- List any applicable penalties in the designated fields, including surcharges, interest, and compromise.

- Sum the penalties to get the total and then calculate the final total amount of remittance.

- Sign the form in the designated area, indicating the printed name, title, and TIN, if applicable.

- Ensure that the necessary documentation is attached, such as the authorization letter if completed by a representative.

- After reviewing all entries, save your changes and choose to download, print, or share the completed form as needed.

Complete your documents online today to ensure timely and accurate submissions.

To download BIR forms, visit the official BIR website where most forms, including the 0619e Form, are available for download. Simply navigate to the forms section, locate the form you need, and download it to your device. This ensures you have the latest version and can fill it out correctly to meet your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.