Loading

Get Annual Return Form Iii Rule 21 4a 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annual Return Form Iii Rule 21 4a online

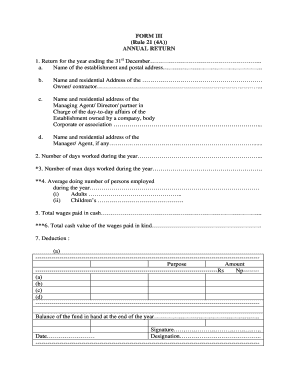

The Annual Return Form Iii Rule 21 4a is essential for reporting operational details and financial transactions for the previous year. This guide will provide you with clear, step-by-step instructions on completing this form online to ensure accurate submission.

Follow the steps to complete your annual return form online.

- Press the ‘Get Form’ button to retrieve the document and open it in the designated editor.

- In section 1, input the return year ending on December 31. Fill in the name of your establishment and its postal address.

- Next, provide the name and residential address of the owner or contractor responsible for the establishment.

- Indicate the name and residential address of the managing agent, director, or partner overseeing daily operations, if applicable.

- If applicable, enter the name and residential address of the manager or agent associated with the establishment.

- In section 2, report the number of working days during the year.

- In section 3, detail the number of man-days worked throughout the year. This represents the total number of attendance days.

- For section 4, calculate and enter the average daily number of persons employed, split into adults and children.

- In section 5, input the total amount of wages paid in cash during the year.

- For section 6, report the total cash value of wages paid in kind, calculated as the difference between the employer’s cost and the actual price paid by employees.

- In section 7, list any deductions by specifying the purpose and amount for each entry.

- Lastly, include the balance of the fund in hand at the year-end, then sign, date, and enter your designation at the bottom of the form.

- Once you have filled in all relevant sections, save your changes, and you can download, print, or share the completed form.

Complete your Annual Return Form Iii Rule 21 4a online today!

A unified annual return combines various reporting requirements into a single document, simplifying the filing process for businesses or organizations. This approach helps streamline compliance, minimizing the risk of errors and reducing administrative burden. It also promotes consistency in how financial information is reported. If applicable, the Annual Return Form Iii Rule 21 4a may include criteria for unified returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.