Loading

Get Form 1446 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1446 online

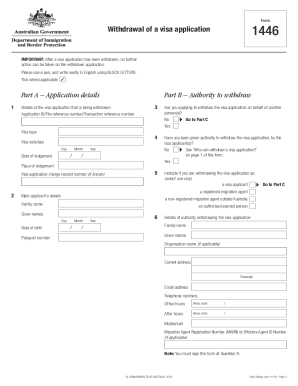

Filling out Form 1446 is essential for individuals wishing to withdraw their visa application. This guide will provide you with comprehensive, step-by-step instructions on how to complete the form online, ensuring an efficient and correct submission.

Follow the steps to complete Form 1446 online

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part A, fill in your application details, including the application ID or transaction reference number and the visa type. Include the date of lodgement and place of lodgement if applicable.

- For Part B, indicate whether you are withdrawing the application on behalf of another person. If yes, provide their details and ensure you have authority to act on their behalf.

- In Part C, provide the personal details for each visa applicant withdrawing the application. Include their family names, given names, dates of birth, nationality, current addresses, and contact information.

- Fill out Part D, where you may provide reasons for the withdrawal. This is optional, so complete it based on your preference.

- In Part E, ensure the declaration is completed. Sign and date the form, noting that all provided information must be true and correct.

- After completing the form, you may save your changes, download, print, or share it as needed before submission.

Complete your Form 1446 online today to ensure a smooth withdrawal of your visa application.

A domestic partner is an individual who resides within the U.S. and is subject to U.S. tax laws on their income. In contrast, a foreign partner resides outside the U.S. and may have different tax obligations related to income generated within the U.S. Understanding this distinction is essential, especially when completing Form 1446 or other tax-related documentation to ensure compliance and avoid issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.