Loading

Get Borang B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Borang B online

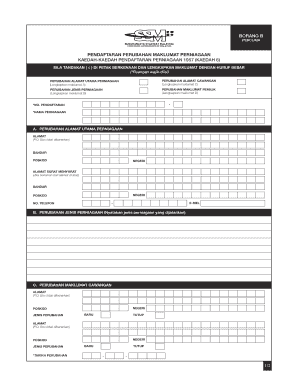

Borang B is an essential document for registering changes in business information. This guide aims to provide clear and actionable steps to complete the form accurately and efficiently online.

Follow the steps to fill out the Borang B efficiently.

- Press the ‘Get Form’ button to access the Borang B online and open it in your preferred editor.

- Indicate the main type of change you are making by checking the appropriate box: whether it is a change of primary business address, branch address, business type, or owner information. Ensure you fill out all required fields denoted with an asterisk (*).

- If you are updating the primary business address, complete the relevant fields including the new address (do not use a P.O. Box), city, postal code, state, and email address, along with the phone number.

- For changes to the type of business, clearly state the new business type you are conducting.

- If you need to update branch information, fill in the new branch address details, specifying if it is a new branch or a closure.

- For owner information changes, provide the owner's full name as per their identification card, along with their identification number, date of birth, citizenship, gender, and residential address.

- In the confirmation section, each sole proprietor or partner must sign the form and provide their identification details to confirm the accuracy of the information provided.

- Once all sections are completed, review the form for accuracy. Users can then save changes, download a copy, print the form, or share it as needed.

Start completing your Borang B online today!

The tax rate for rental income in Malaysia generally falls under the individual income tax rates, which range from 0% to 30% depending on your total earnings. If you earn rental income, reporting it using Borang B is essential for accurate tax calculation. Staying informed about these rates helps you manage your finances effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.