Loading

Get Form No 16 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form No 16 online

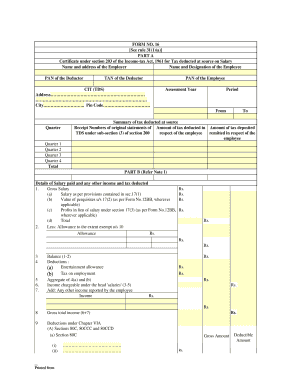

Filling out Form No 16 online is an essential process for individuals to report their income and tax deductions. This guide will provide you with clear instructions and helpful insights to ensure the completion of the form is straightforward and efficient.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin filling out Part A of the form by entering the name and address of the employer. Ensure that all details are accurate and up to date.

- Input the name and designation of the employee, as well as their PAN (Permanent Account Number) and the TAN (Tax Deduction and Collection Account Number) of the deductor.

- Complete the address section, including city and pin code, followed by specifying the assessment year and the period of employment.

- Document the summary of tax deducted at source by entering the receipt numbers for original statements and the amount of tax deducted and deposited for each quarter.

- Proceed to Part B, where you will detail the salary paid and any other income. Start by entering the gross salary and applicable deductions, followed by all relevant allowances.

- Carefully calculate the balance after allowances and deductions, leading to the income chargeable under the head 'salaries'.

- Add any other income reported by the employee to arrive at the gross total income.

- Follow with the deductions under Chapter VIA, ensuring to record each section and the appropriate deductible amounts.

- Finalize the form by calculating total income, tax on total income, and any applicable cess. Ensure to verify the tax payable after accounting for any relief.

- In the verification section, provide your name, designation, and a signature certifying the accuracy of the entries made in the form.

- Once all information is complete, you can save the changes, as well as the option to download, print, or share the completed form.

Start filling out your Form No 16 online today for a smoother tax declaration process.

To extract a Form No 16A zip file, start by downloading the zip file associated with your TDS filing. Once downloaded, right-click on the file and select 'Extract All' or a similar option depending on your operating system. After extraction, you will find the documents you need, including Form No 16A, ready to help you in understanding your tax deductions and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.